Venture town hot, Naval wins, and Crypto wiped out

🗓 Morning, folks!

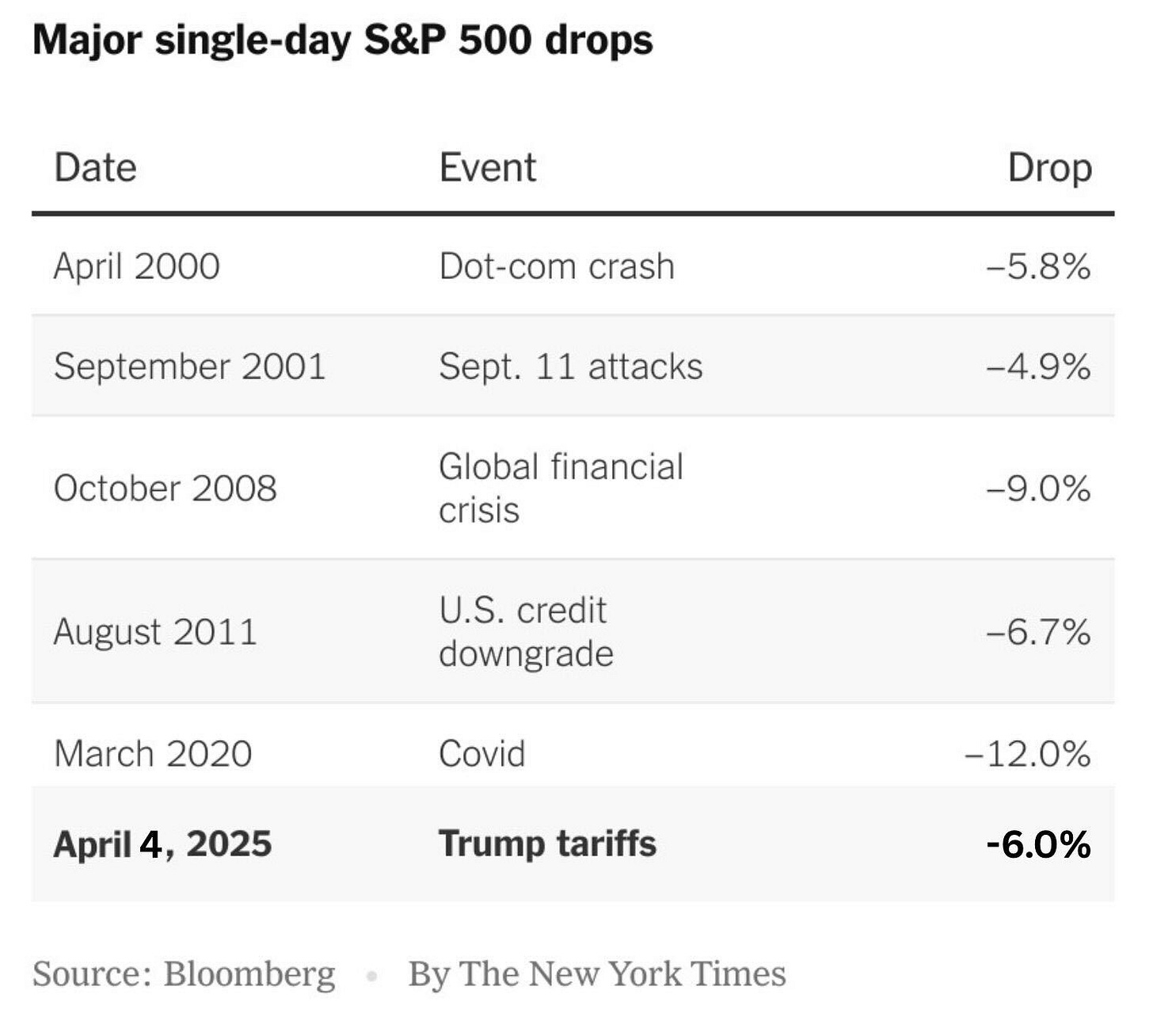

Markets nosedived on Monday, with Sensex crashing nearly 3% and Nifty shedding over 3%—one of the steepest falls in recent memory. Every sector closed in the red, with metals, autos, and IT stocks taking the worst hit.

Realty plunged over 7%, and India VIX, a measure of volatility, spiked a record 65%, flashing signs of extreme panic.

💡 Spotlight: Crypto wasn’t spared either. Bitcoin slipped below $80K, and Ethereum followed suit, as Trump’s aggressive tariff talk rattled global risk assets.

With Wall Street logging its worst day since 2020 and recession fears back on the table, traders are now pricing in an early Fed rate cut.

Anyway, easy news day today. Let’s get through it and leave you to better things. ☕

1 Big Thing: ITC cooks up a cold deal 🍗

Consumer giant ITC is picking up a 43.8% stake in Ample Foods for ₹131 crore, further pushing into India’s fast-growing frozen and ready-to-eat food market.

The deets: Ample Foods owns brands like Prasuma—best known for its momos—and Meatigo, which offers premium deli meats, sauces, marinades, and frozen snacks. Products are sold online, in stores, and via their own online platforms.

Ample will continue operating independently, but with ITC’s distribution power and strategic backing in the background.

Combined, Ample Foods and its related companies clocked ₹131 crore in revenue in FY24, up from ₹111 crore in FY23 and ₹91 crore in FY22. At a roughly 2x sales multiple, the deal looks like a bargain for ITC.

Worth noting: this is ITC’s second acquisition in a week. Just days ago, it announced a ₹3,498 crore deal for Century Pulp and Paper, boosting its packaging business.

While we’re on acquisitions…

Metropolis Healthcare is buying Dehradun-based Dr. Ahuja’s Pathology in an all-cash ₹35 crore deal.

This will mark Metropolis’ third buy in North India after Core Diagnostics and Scientific Pathology in recent months.

2. Venture town hot 💰

Juspay raised $60 million in new funding round led by Kedaara Capital.

The deets: Juspay is a payments technology company offering checkout, payment orchestration, authentication, and tokenization solutions for banks and merchants.

Juspay helps handle over 200 million payments every day and processes around $900 billion worth of payments in a year.

By the numbers: Juspay’s FY24 revenue rose nearly 50% to ₹319.3 crore from ₹213.4 crore in FY23. Losses narrowed slightly to ₹97.5 crore, down 7.8% from last year.

Worth noting: just days ago, the company was dropped by Paytm and a few other clients over performance and compliance concerns.

While we are on fundraises, ☝️

Easebuzz raised $30 million in a fresh round led by Bessemer Venture Partners, marking its first major fundraise since 2021.

The deets: the company helps businesses, especially in education, real estate, and government manage digital payments with plug-and-play software tools. It currently serves over 10,800 educational institutions and processes $3 billion in transactions monthly.

3. India’s hidden naval weapon 🛥️

India is building a stealth naval base on the east coast near Rambilli, Andhra Pradesh, designed to host nuclear submarines and warships. The base, part of Project Varsha, is expected to be commissioned by 2026.

Why it matters: this isn’t just another military base. It’s India’s version of China’s Hainan—an underground facility with deep-water access that allows submarines to slip in and out undetected, even by satellites.

That level of stealth is critical for Submersible Ship Ballistic Missile Nuclear submarines (SSBN), which carry nuclear missiles and need to stay hidden for months.

Once live, the Rambilli base will support India’s growing nuclear submarine fleet, including the upcoming INS Aridhaman. It’s India’s third SSBN and will carry more K-4 missiles than its predecessors, INS Arihant and INS Arighaat.

On another note: on the west coast, India is scaling up Karwar under Project Seabird. With upgrades inaugurated just this weekend, the base will soon handle 32 ships and submarines—more than triple its original capacity.

Bottomline: with Project Varsha in the east and Seabird in the west, India is quietly building a two-coast nuclear deterrent. It’s one of the most strategic defence upgrades in recent years.

5. Stocks that kept us interested 🚀

1. Tariff speed bump for Tata Motors

Tata Motors took a sharp hit on Monday as Jaguar Land Rover (JLR) hit the brakes on U.S. shipments following Trump’s 25% auto tariff move.

Why it matters: JLR imports and sells a big chunk of its cars in the U.S., so the new tariffs hit it hard. The tariff pause could slow sales & drag near-term earnings.

Zoom out: Tata Motors stock has already lost 40% in value over the past year. The U.S. tariff move may be short-term, but for now, it’s another roadblock in Tata’s global recovery journey.

2. AstraZeneca gets green light for key Cancer drug

AstraZeneca Pharma received approval to import and sell Osimertinib Tablets, expanding its cancer treatment lineup in India.

The deets: Osimertinib is a cancer medicine used along with chemotherapy. It is approved as a first treatment for people with advanced or spread-out non-small cell lung cancer (NSCLC).

This approval allows AstraZeneca to begin marketing the drug in India, pending other statutory clearances.

Why it matters: lung cancer is one of the most common and deadly cancers in India. Expanding access to targeted therapies like Osimertinib strengthens AstraZeneca’s oncology portfolio and helps meet rising demand for advanced treatment options.

6. Story in data: Stack not stash 📊

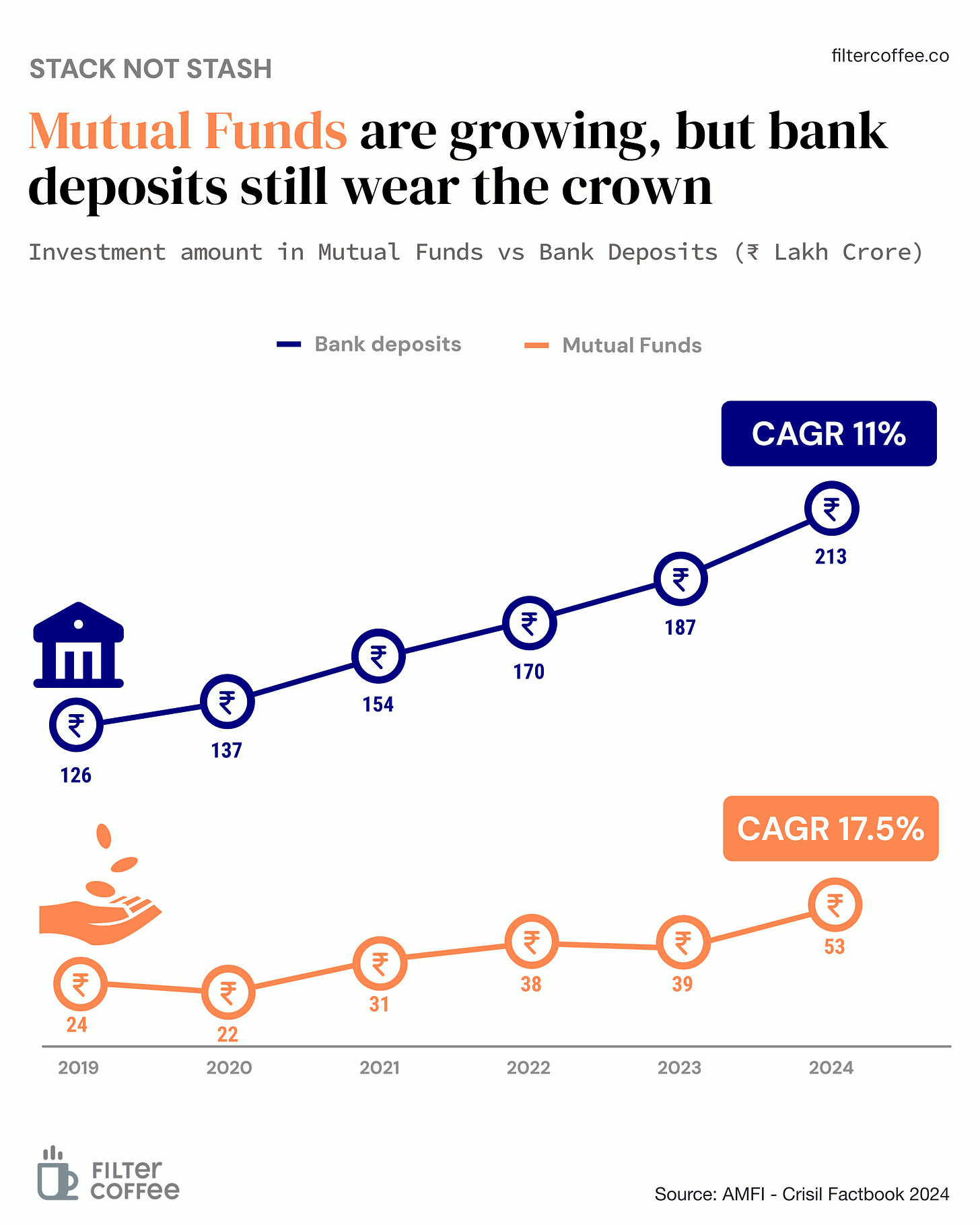

Despite a strong 17.5% annual growth in mutual fund assets over the last five years, traditional bank deposits still hold the lion’s share of India’s household financial assets.

It’s a reminder that while more Indians are venturing into markets, the safety and familiarity of fixed deposits continue to dominate long-term savings behavior.

What else are we snackin’ 🍿

📉 Tariff tactics: Apple and Samsung are shifting more production to India to dodge steep U.S. tariffs on Chinese and Vietnamese goods.

🍴 Serving notice: Zomato’s Food Delivery COO Rinshul Chandra resigned to explore new opportunities, triggering a stock dip.

🧾 China cutback: Microsoft's JV Wicresoft is shutting China operations, laying off 2,000 staff as it ends local support outsourcing.

🔋 Power backup: Tata Power got the green light to set up a giant 100 MW battery system in Mumbai to keep hospitals, airports, and key services running during power cuts.

⛽ Fuel hike: Centre hiked excise duty on petrol and diesel by ₹2/litre each, effective Tuesday, petrol now taxed at ₹13, diesel at ₹10.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.