Zetwerk plans an IPO, Government wants reels, and A chip bet.

☀️ Good Morning, it’s Monday.

Markets tried to keep the party going but lost steam fast.

Sensex & Nifty ended flat, as IT stocks dragged the mood down.

💡 Spotlight: India’s auto market had a mixed February. Passenger vehicle sales hit a record 3.8 lakh units, up 2% YoY, while two-wheelers stalled.

Three-wheelers, however, picked up pace, showing a shift in consumer demand.

Let’s hit it!

1 Big thing: Zetwerk is gearing up for an IPO 💰

Zetwerk, the marketplace for precision components and bespoke manufacturing, is prepping for an IPO, aiming to raise up to $500 million at a $5 billion valuation.

The IPO could still be 15 months away though, thanks to the ongoing market slump.

What to know: Zetwerk services customers across a wide range of industries, from aerospace to consumer electronics. The business was valued last at $3.1 billion.

The twist: Zetwerk started as a platform connecting manufacturers with customers, but it's now becoming a manufacturer itself—building the very products its clients need.

- Last week, the company launched its 7th manufacturing facility in Chennai, this one dedicated to electronics manufacturing.

While we’re on IPOs…

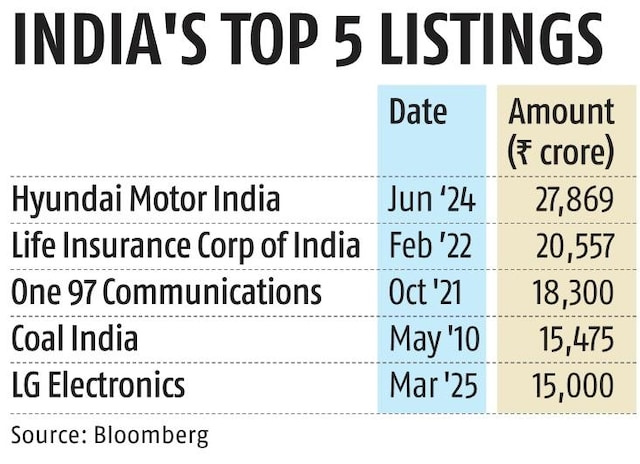

LG Electronics India just got SEBI’s nod for a ₹15,000 crore IPO.

The offering is entirely an offer for sale (OFS) and will see parent company LG offload a 15% stake.

If it goes live soon, this could be India’s fifth-largest IPO—just behind Hyundai’s blockbuster ₹27,870 crore listing last year.

2. Scopely is catching ‘em all 🎮

Niantic, the company behind Pokémon GO, is selling its gaming business to Scopely in a $3.5 billion deal.

This comes as one of the biggest gaming acquisitions in recent years.

Scopely is a leading mobile gaming company known for developing and publishing popular live-service games

Why it matters: this means Pokémon GO, Pikmin Bloom, and Monster Hunter will now live under Scopely’s umbrella.

The backstory: Niantic originally set out to build a future around augmented reality (AR), but struggled to scale its platform beyond Pokémon GO.

By the numbers: Niantic's games still pull in over 30 million monthly players, and Pokémon GO alone hit 100 million unique players in 2024, nearly a decade after launch.

The franchise has remained a top 10 mobile game every year since launch, generating over $1 billion in revenue last year.

3. GOI bets on creators ✔

The government just announced a $1 billion fund to back India's digital creators.

The deets: through this fund, the government plans to provide digital creators with better tools, access to capital, and resources to scale globally.

It also includes setting up the Indian Institute of Creative Technology (IICT) near Mumbai’s Film City to train the next generation of content creators.

Information and Broadcasting Minister Ashwini Vaishnaw highlighted that this fund will empower creators to enhance their production quality and expand their international presence.

And of course, it’s a big win for influencers looking to turn their side hustle into a full-blown business.

Worth noting: as part of this fund, India is also launching WAVES (World Audio Visual & Entertainment Summit) from May 1-4 in Mumbai, aimed at connecting creators, investors, and global media leaders to push India’s content industry onto the global stage.

With 850 million+ internet users and a booming creator economy, India’s digital content scene is already thriving. This fund could help push it further into the global spotlight.

4. Softbank’s new data center 🤝

SoftBank just dropped $676 million to buy and convert a former Sharp LCD factory into a next-gen AI data center.

Why it matters: the Osaka, Japan based facility is set to become one of Japan’s largest AI data centers, fueling everything from OpenAI model training to enterprise AI solutions.

AI models need serious computing power, and data centers are the backbone of this new AI era. By securing its own facility, SoftBank reduces reliance on third-party cloud providers.

SoftBank is also eyeing a $25 billion investment in OpenAI at a staggering $300 billion valuation.

Big picture: with OpenAI, Oracle, and other giants ramping up AI data centers in the U.S., SoftBank is making sure Japan isn’t left behind.

The factory-turned-data-center is set to go live in 2026.

While we’re on acquisitions…

Coromandel International picked up a 53% stake in agrochemical firm Nagarjuna Agrichem (NACL) for ₹820 crore.

Coromandel is an agri-solutions company specializing in fertilizers, crop protection, and specialty nutrients.

The move strengthens Coromandel’s crop protection business, adding NACL’s manufacturing and R&D capabilities to its arsenal.

With India’s agrochemical market set to hit $14.5 billion by 2028, this deal positions Coromandel for serious growth.

5. Major stock market moves to keep up with 🚀

- L&T, a global giant specializing in infrastructure, power, and water management, secured a ₹2,500-5,000 crore order in Saudi Arabia to build a massive desalination plant with ACWA Power. L&T company is a global EPC giant specializing in infrastructure, power, and water management. The project will convert seawater into drinking water, expanding L&T’s Middle East presence.

- VA Tech Wabag jumped 2.4% after bagging new orders from Indian Oil and GAIL to build wastewater recycling plants. VA Tech, a leader in water treatment solutions, also won a ₹20 crore repeat operation & maintenance order from IOCL for its Panipat refinery’s water recycling facility.

- Polycab India, a top manufacturer of electrical wires, cables, and network solutions, secured a ₹3,003 crore contract from BSNL to build and maintain the BharatNet middle-mile network in Bihar. This deal will boost rural internet expansion. The company will manage material supply, installation, and network operations.Share

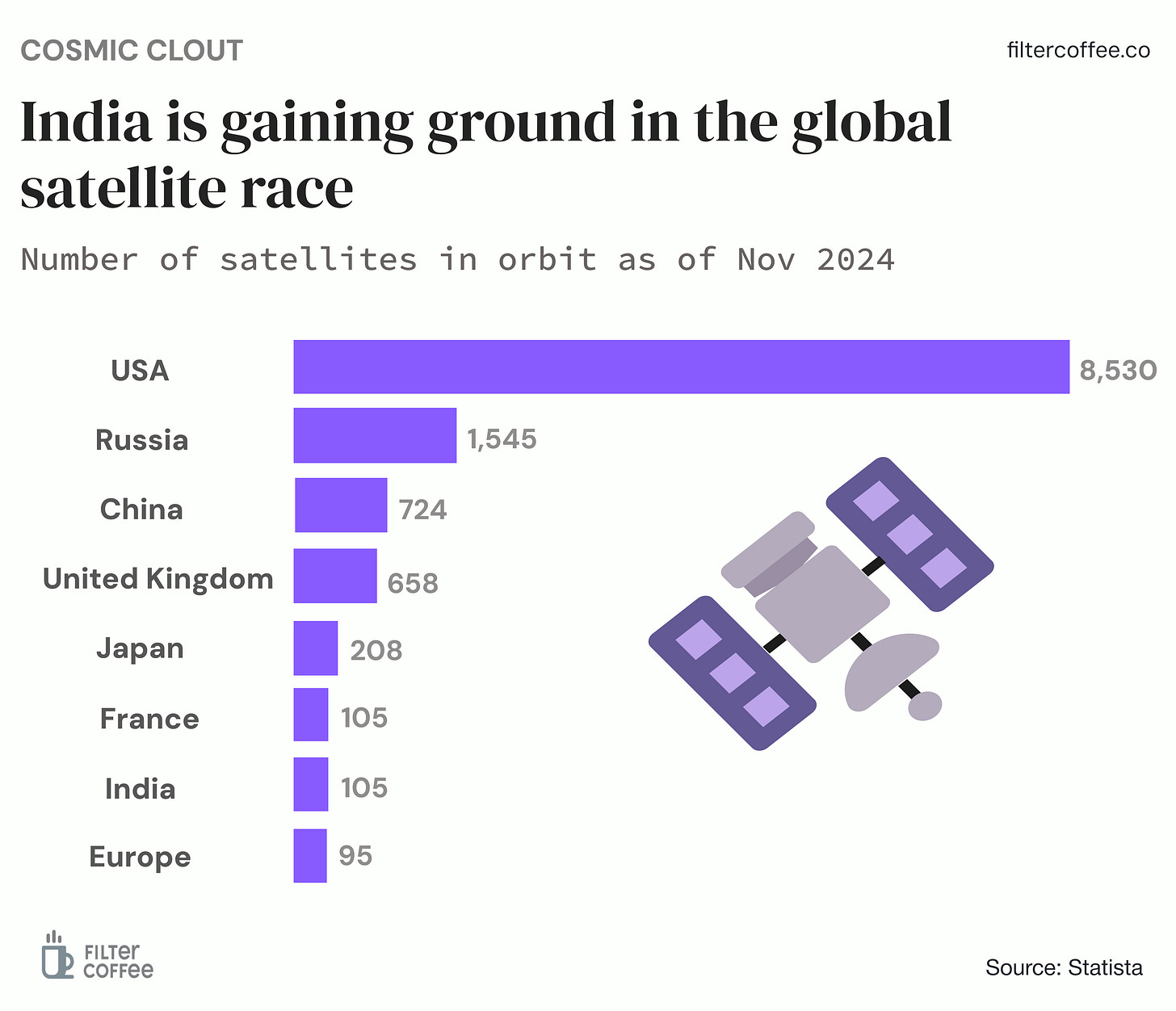

6. Story in data — Space momentum 📡

India’s space program has always been known for doing more with less—but now, with satellite demand rising and private sector interest growing, the country is putting more money behind its ambitions.

Furthermore, the push toward commercialisation and private investment is opening new opportunities.

As more investment follows, India could rapidly scale up satellite manufacturing, commercial launches, and further deep space programs.

Globally the space economy is expected to hit $1 trillion by 2040.

What else are we snackin’ 🍿

🚀 Chip shift: tech veteran Lip-Bu Tan is taking over as Intel’s CEO, replacing Pat Gelsinger, who stepped down in December.

🌖 Space steps: ISRO successfully de-docked SpaDeX satellites—a key move for future moon missions, human spaceflight, and India’s space station ambitions.

💰 Future finance: SBI is launching a new unit to fund AI, e-commerce, and fintech, expanding beyond its traditional infra financing.

📱 Gemini takeover: Google is replacing Google Assistant on Android phones with Gemini later this year.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.