Trents earnings, Insurance IPO, and Pharma win.

🗓 Morning, folks.

Morning, folks! Markets ended largely flat on Monday, though the Sensex managed to rise nearly 1% and the Nifty closed 0.3% higher.

Defence stocks continued to rally for the second straight session, jumping between 3% and 10%. IT stocks staged a smart comeback, with Tech Mahindra, LTIMindtree, and Persistent Systems leading the gains.

Spotlight: foreign investors just logged their longest buying streak in nearly two years, pumping $4.1 billion into Indian equities over the past nine sessions.

What’s driving it: rising hopes of a U.S.-India trade deal, attractive stock valuations, and India’s positioning as a relative safe haven.

With global trade tensions rising, India looks better insulated than China or the U.S.—and it’s still on track to be the fastest-growing major economy in FY26.

Let’s hit it!

1 Big Thing: Trent reports a mixed bag Q4 but investors are cheering 📊

Trent’s Q4 profit may have dropped, but the stock jumped over 5%, because the market saw through the noise.

By the numbers:

- Revenue: ₹4,106 crore, up 28.8% YoY vs ₹3,187 crore

- EBITDA: ₹656 crore, up 37.5% YoY vs ₹477 crore

- EBITDA Margin: 16% vs 15% YoY

- Net Profit: ₹350 crore, down 46.5% YoY vs ₹654 crore

What’s happening: behind the numbers, Trent’s story remains one of momentum. Westside added 13 stores in FY25, while Zudio—its affordable fashion rocket—opened 132 new outlets, including two in the UAE.

It now has 765 stores and continues to charge ahead in Tier-2 and Tier-3 cities.

The secret sauce: over 80% of sales come from private labels, backed by tight inventory cycles and faster design-to-shelf execution. That means fresh collections, better margins, and more loyal customers.

Zoom out: with India’s fashion retail market growing 18–20% annually, players like Reliance Trends and Shoppers Stop are ramping up their value play.

But Trent’s early lead, strong brand recall, and disciplined expansion are keeping it well ahead of the pack.

2. Canara HSBC Life files for IPO 📄

Another financial player is eyeing the public markets.

Canara HSBC Life Insurance, a subsidiary of Canara Bank, has filed draft papers for an IPO.

The offering will be a pure offer for sale (OFS) by Canara Bank, HSBC Insurance (Asia-Pacific) Holdings, and Punjab National Bank. No new shares will be issued.

The deets: the company offers life insurance products including term plans, savings plans, and retirement solutions. Canara Bank owns 51%, HSBC holds 26%, and PNB the remaining 23%.

An OFS allows existing shareholders to sell their stake to the public, meaning the company doesn’t raise fresh capital.

By the numbers: the insurer manages over ₹40,000 crore in assets and posted a ₹113 crore profit in FY24, up 24.3% YoY.

Why it matters: the IPO lands at a time of market volatility, and insurance listings have been rare. For Canara Bank, this is part of a broader play to unlock value from its subsidiaries and boost capital.

Context: just last month, Canara Robeco Mutual Fund—another Canara Bank-backed company filed for an IPO through a similar OFS structure. The bank is trimming non-core holdings to focus on its main lending business and strengthen its balance sheet.

3. Japan & Singapore tap into India’s green Gold 🤝

India is set to export 4.12 lakh tonnes of Green Hydrogen derivatives to Japan and Singapore.

The deets: green hydrogen derivatives are clean fuels made from hydrogen using renewable energy.

India is set to export 4.12 lakh tonnes of green hydrogen derivatives to Japan and Singapore.

The deets: these clean fuels, made using renewable energy, will power hard-to-decarbonise sectors like shipping, steel, and power in both countries, replacing coal and oil with greener alternatives.

Why it matters: India is turning its solar and wind strength into export dollars. With Japan and Singapore looking to slash emissions, India’s early bet on green hydrogen is opening up high-value markets, and positioning it as a serious player in the global clean energy race.

Zoom out: green hydrogen derivatives are emerging as the next-gen fuels for heavy industries and long-haul transport, where batteries fall short. With the National Green Hydrogen Mission and fresh certification rules in place, India is laying the groundwork to lead the global clean fuel export game.

4. Stocks that kept us interested 🚀

1. IOL Chemicals gets China’s stamp for Ibuprofen

IOL Chemicals received approval from China’s drug regulator to export its Ibuprofen drug.

The deets: IOL Chemicals is one of India’s top makers of active pharmaceutical ingredients (APIs).

Meanwhile, Ibuprofen is a go-to medicine for pain relief, inflammation, and fever. With this approval, the company can now directly sell Ibuprofen in the massive Chinese market.

Why it matters: breaking into China’s tightly regulated pharma market is no small feat. It opens a huge new revenue stream for IOL and reduces its reliance on traditional export markets..

Zoom out: the global Ibuprofen market is worth around $6.5 billion and growing steadily with rising demand for OTC medicines.

China alone accounts for roughly 15% of global Ibuprofen consumption, making it a critical market to enter.

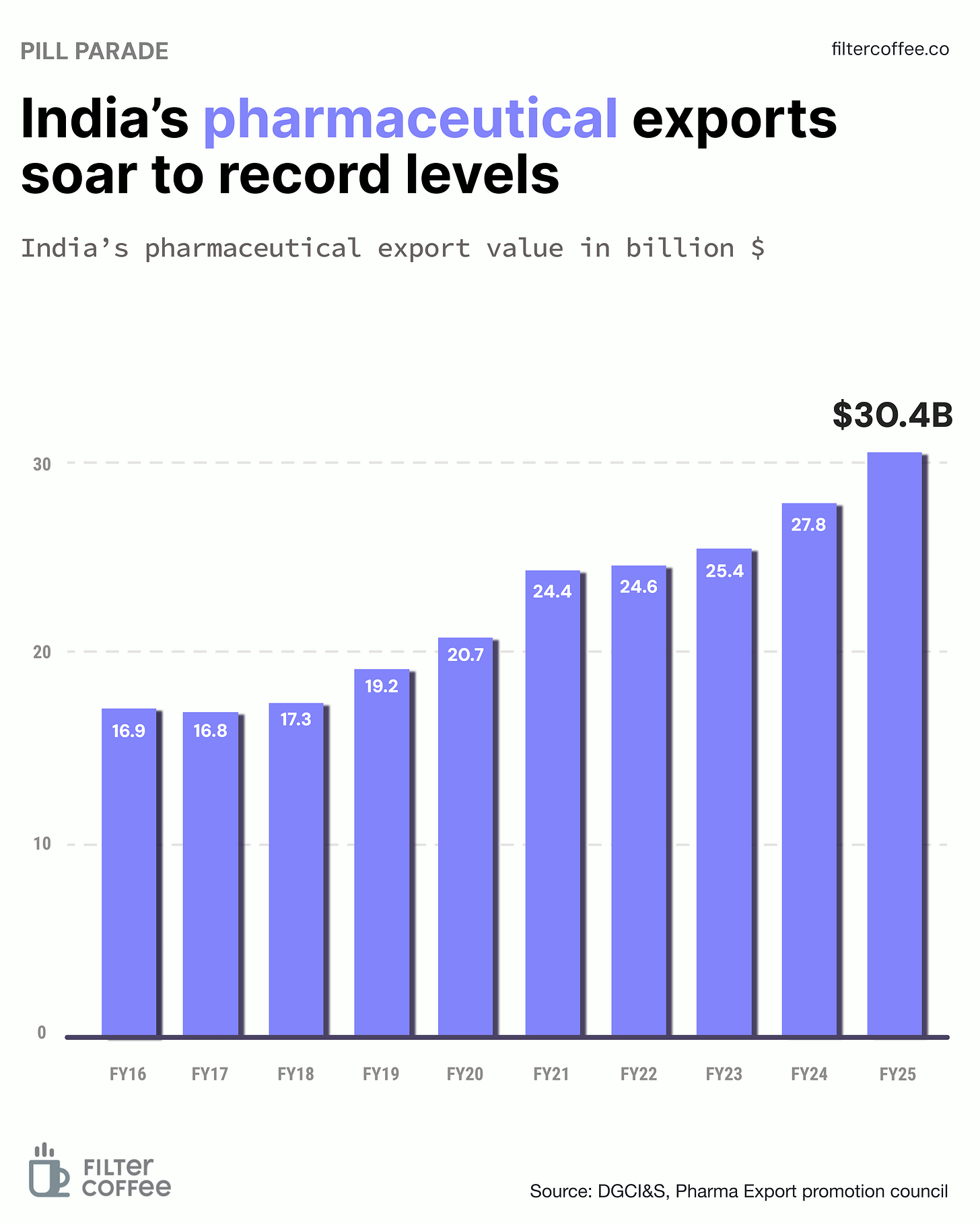

Meanwhile, India’s pharma exports hit a record $27 billion in FY24, with APIs like Ibuprofen growing at 9% annually. IOL’s entry into China fits a bigger story, Indian pharma firms are grabbing more global share post-COVID.

What else are we snackin’ 🍿

🚢 Shipping boost: French shipping giant CMA CGM has launched its first Indian-flagged container vessel, CMA-CGM Vitoria, from Mumbai — marking a milestone for India's maritime sector.

🛰️ Orbit battle: Amazon launched its first Kuiper internet satellites, kicking off its plan to challenge Elon Musk’s Starlink in the space internet race.

💻 IBM boost: IBM is planning to invest $150 billion in the US over five years, including $30 billion for mainframe and quantum R&D.

🏥 Max expansion: Max Healthcare will invest ₹6,000 crore by 2028 to add 3,700 beds across India, aiming to grow its network to 30 hospitals from the current 22.

🧠 Infosys AI: Infosys launched Topaz, a new AI suite to help businesses shift to SAP S/4HANA Cloud. The tools run on Infosys’ Cobalt cloud platform.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.