Women power SIPs, IPO rush continues, and Samsung tops apples.

🗓 Morning, folks! Markets closed sharply lower on Thursday, with Nifty snapping its six-day winning streak amid broad-based selling. Both Sensex and Nifty ended lower by 1% each as weakness spread across sectors.

Tata Motors led the losers, falling 3.5% ahead of Jaguar Land Rover’s investor meet on June 16. Other major drags included Trent, Shriram Finance, Titan, and Coal India.

Spotlight: a tragic air crash near Ahmedabad has claimed the lives of all 242 people aboard a London-bound Air India Boeing Dreamliner.

The aircraft crashed shortly after takeoff on Thursday, marking what could be one of India’s deadliest air disasters in nearly three decades. There are no reported survivors. Investigations are underway to determine the cause of the crash.

1 Big thing: India eyes ₹2 trillion defence ramp-up 🛡️

The Defence Ministry is gearing up to sign ₹2 trillion worth of defence contracts this year, with the bulk set to go to Indian firms.

What’s going on: the Ministry of Defence (MoD) looks to sustain the procurement momentum from FY25. Last year, the MoD signed 193 contracts, out of which 177 (92%) went to domestic companies, with a value of about ₹1.69 trillion, representing 81% of the total spend.

The why: maintaining this high level of utilisation and domestic sourcing is to make sure that the ministry strengthens its case for a bigger defence budget going forward.

A larger domestic base enhances supply chain resilience in critical areas.

Zoom out: as part of this strategy, foreign OEMs will now be required to set up manufacturing operations in India if they want to participate in procurement orders. This is aimed at driving greater localisation and ensuring that more high-end defence tech is built in-country.

Key focus: India has a vibrant civilian drone ecosystem but most systems are still not military-grade. Recent trials showed only a handful around three to four promising companies are currently close to meeting required standards. Some of these players are fully indigenous, while others are working with foreign technology partners.

While we are on important government decisions,

Two new railway capacity expansion projects worth ₹6,405 crore have been approved to improve goods movement across key industrial corridors in India.

The deets: the projects include Koderma–Barkakana track doubling (133 km) in Jharkhand and Ballari–Chikjajur doubling (185 km) across Karnataka and Andhra Pradesh.

Together, these lines will form a faster link between India’s eastern and southern regions, helping to connect inland production hubs with ports.

The Ballari–Chikjajur route will now better serve Mangaluru Port, reducing the need to route shipments via Goa or Krishnapatnam Port.

The Koderma–Barkakana line, meanwhile, will create a more efficient rail link between Patna and Ranchi through coal-rich regions.

Why it matters: the upgrades will ease congestion, improve service reliability, and unlock 49 million tonnes of extra freight capacity per year.

Zoom out: a stronger rail network will also help lower India’s logistics costs, currently estimated at 7.8–8.9% of GDP. Even a 1% reduction in logistics costs can make India’s industries more globally competitive and help boost exports.

2. IPO rush shows no signs of slowing 📈

Adani to list airport biz by 2027.

Adani Group is gearing up to take its airports business public by 2027, while fast-tracking its massive $100 billion investment push across businesses.

The deets: The airport unit, currently housed under Adani Enterprises, will likely be spun off and listed by March 2027.

Adani Airport Holdings is already India’s largest private airport operator, managing eight airports across the country. It is also set to open a new terminal near Mumbai in the coming months.

Meanwhile, the group is also accelerating its capex timeline as what was earlier a 10-year, $100B plan will now be executed in just 5-6 years. The bulk of this investment will go into energy, logistics, and infrastructure businesses.

More on IPOs,

Orkla India, the packaged food player formerly known as MTR Foods, has filed for an IPO with SEBI via a full Offer For Sale (OFS).

The company itself will not receive any proceeds as all funds will go to the selling shareholders. The IPO is being managed by ICICI Securities, Citigroup Global Markets India, JP Morgan India, and Kotak Mahindra Capital Company.

Zoom out: packaged foods are big businesses and growing fast. Currently, 65-70% of demand comes from urban India, but rural markets are gaining ground, thanks to rising incomes, better infrastructure, and wider media reach.

Brands, including Orkla, are ramping up distribution and availability in rural areas to tap this next big wave of demand.

More on IPOs,

HDB Financial Services, the NBFC arm of India’s largest private bank HDFC Bank, is gearing up to launch a ₹12,500 crore IPO by mid-July, potentially the biggest listing of 2025 so far.

The deets: the company is preparing to file its Updated Draft Red Herring Prospectus (UDRHP) this month, the final precursor before filing the main RHP. If all goes to plan, the IPO will hit the markets in early to mid-July, provided market conditions remain stable.

3. Giva sparkles with ₹450 cr fundraise 💎

Omnichannel jewellery startup Giva will raise ₹450 cr in Series C round led by Creaegis.

The deets: Creaegis, through its CIF II Scheme, will invest $27.6 million, while Premji Invest is bringing in $14.7 million.

Giva started as an affordable jewellery brand and has since expanded into gold and lab-grown diamonds. The brand now runs 150 stores across India through a franchise-led model, alongside a strong digital presence via its website and app.

With this fundraise, Giva’s valuation will double to $465 million.

The brand is building momentum as its FY24 revenue surged 66% YoY to ₹274 crore, though losses widened to ₹59 crore. As the Indian jewellery market goes increasingly digital + omnichannel, Giva is positioning itself to compete with players like Bluestone, CaratLane, and Melorra.

4. OpenAI eyes big billions for AI infra 🤖

OpenAI is in talks to raise $40 billion from heavyweights like Reliance Industries, Saudi Arabia’s PIF, and UAE’s MGX as it looks to supercharge its AI ambitions.

The deets: each investor could reportedly chip in hundreds of millions in this fundraise.

OpenAI is also seeking another $100 million each from Founders Fund and Coatue. In total, it expects to raise around $17 billion more in 2027 to fuel development and its mega infrastructure plan - Stargate.

Why it matters: Stargate is aiming to deploy $500 billion over time, starting with an initial $100 billion spend. The plan includes building massive data centres and AI campuses that can support OpenAI’s next-gen models and products.

Zoom out: as the global race to build AI infrastructure at scale heats up, OpenAI is moving fast to lock in capital and partnerships. If these deals land, it will mark one of the largest private fundraises ever in tech and put OpenAI firmly in the AI superleague.

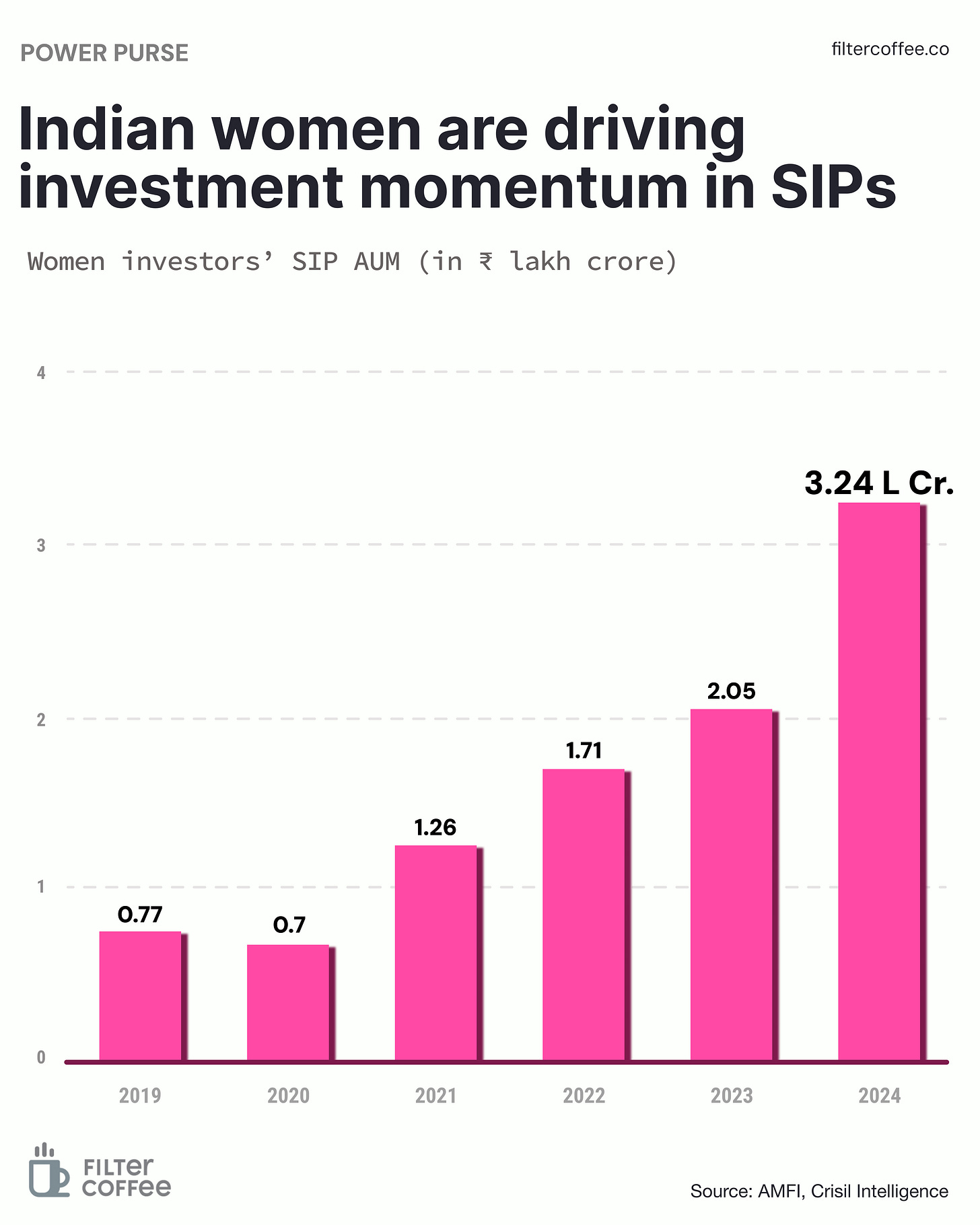

5. Story in data: Women power SIP boom 📊

Women investors are becoming a force in India’s mutual fund landscape.

In just five years, SIP assets under management by women have jumped more than 4x, from ₹0.77 lakh crore in 2019 to ₹3.24 lakh crore in 2024.

That’s a compound annual growth rate (CAGR) of nearly 33%. The sharpest rise came in 2024, adding over ₹1.2 lakh crore in a single year.

As financial literacy improves and incomes rise, women are taking charge of long-term wealth building like never before.

What else are we snackin’ 🍿

📱 Samsung tops Apple: Samsung assembled more phones in India last year, 25% of its global output vs Apple’s 15%.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.