Billion dollar oil, IPOs are back, and Tariff truce.

🗓 Morning, folks.

It’s that kind of week where your calendar says “work,” but your brain still thinks it’s a holiday.

💡 Spotlight: while we’re figuring out what day it is, Coca-Cola was all gas, no brakes at the Maha Kumbh.

The company set up 1,400 mobile stations and a 100-cooler wall at the event, serving over 180 million drinks, roughly one for every fourth Indian.

The Maha Kumbh drew an estimated 660 million people this year, making it the world’s largest in-person gathering—and a marketer’s paradise.

Thanks to this campaign,Coca-Cola's India volumes grew in double digits this quarter.

Anyway, easy news day today. Let’s get through it and leave you to better things. ☕

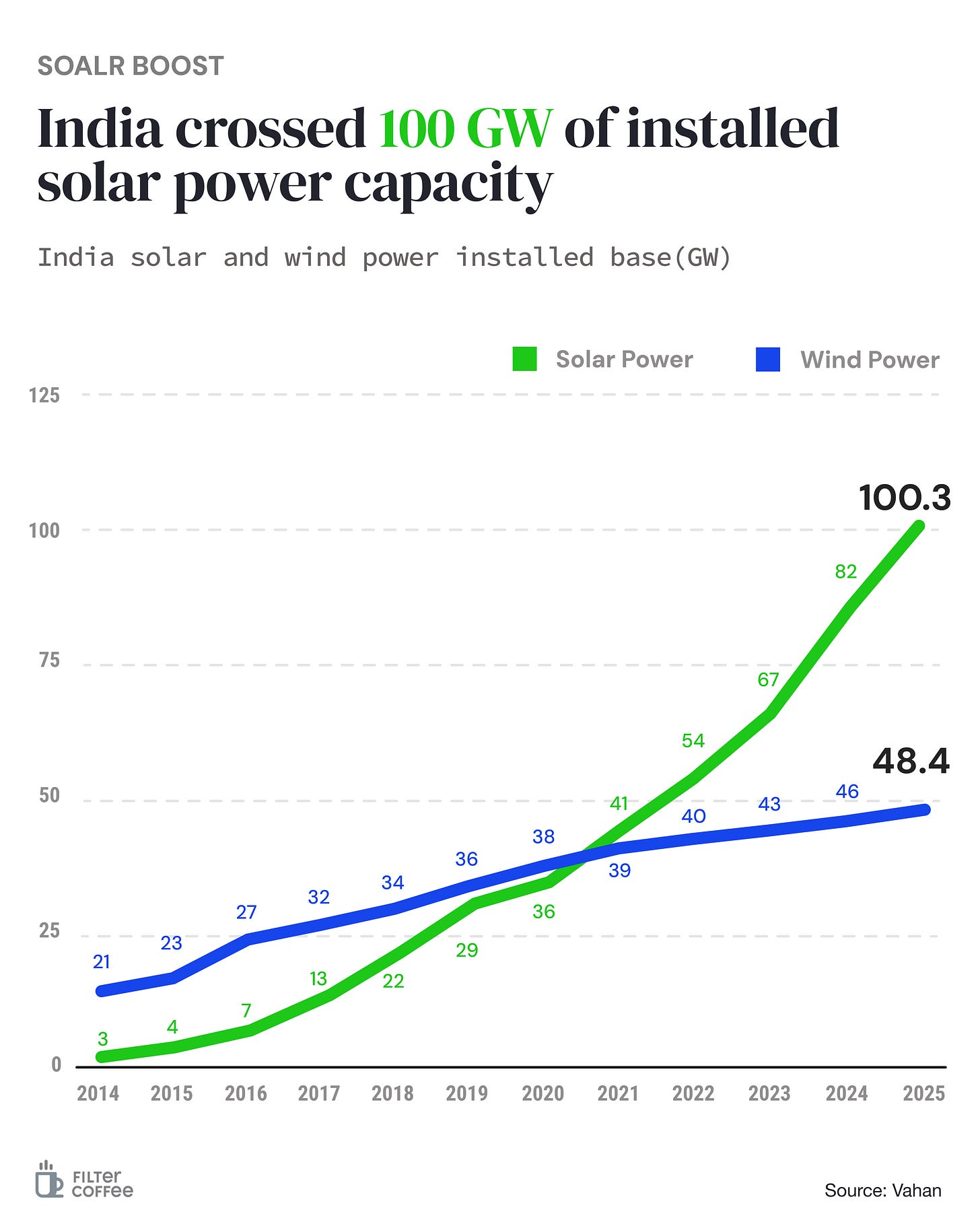

1 Big Thing: Inox Green makes a solar debut ☀️

Inox Green is moving beyond wind. The company just bagged a 675 MWp operations and maintenance (O&M) contract for solar farms across India, its first in the solar space.

Inox Green, part of the $12 billion INOX Group, currently manages wind farms. With this move, it’s stepping into cleaning, monitoring, and repairing solar plants too.

The deets: 675 MWp is enough to power over 1 million Indian homes. The project, awarded by a major renewable player, is spread across multiple states.

The why: solar O&M gives Inox Green a broader footprint across the clean energy stack—not just turbines, but panels too. Unlike building new projects, O&M offers steady, low-risk cash flows.

Background: Inox Green joins peers like Tata Power Solar, ReNew Power, and Sterling & Wilson in the solar O&M space.

2. Zomato slows, Blinkit zooms 🛵

Eternal (formerly Zomato) just dropped its Q4 results—and it’s a tale of two businesses.

Food delivery, the OG engine, is showing signs of fatigue. Profit dropped 78% year-on-year, and orders barely moved. The company blamed a sluggish demand environment, delivery partner shortages, and pressure from quick commerce players offering ready-to-eat meals.

Meanwhile, Eternal shut down Zomato Quick and Everyday—its 10-minute and homely meal bets—citing poor ROI and operational hurdles.

But over in quick commerce, Blinkit is flying. Revenue more than doubled, GOV is up, and it opened nearly 300 new stores in a single quarter. Losses widened—but the company says that’s part of the plan as it races to 2,000 stores by year-end.

Bottomline: food delivery might be maturing, but Eternal’s future looks increasingly tied to Blinkit and the speed game.

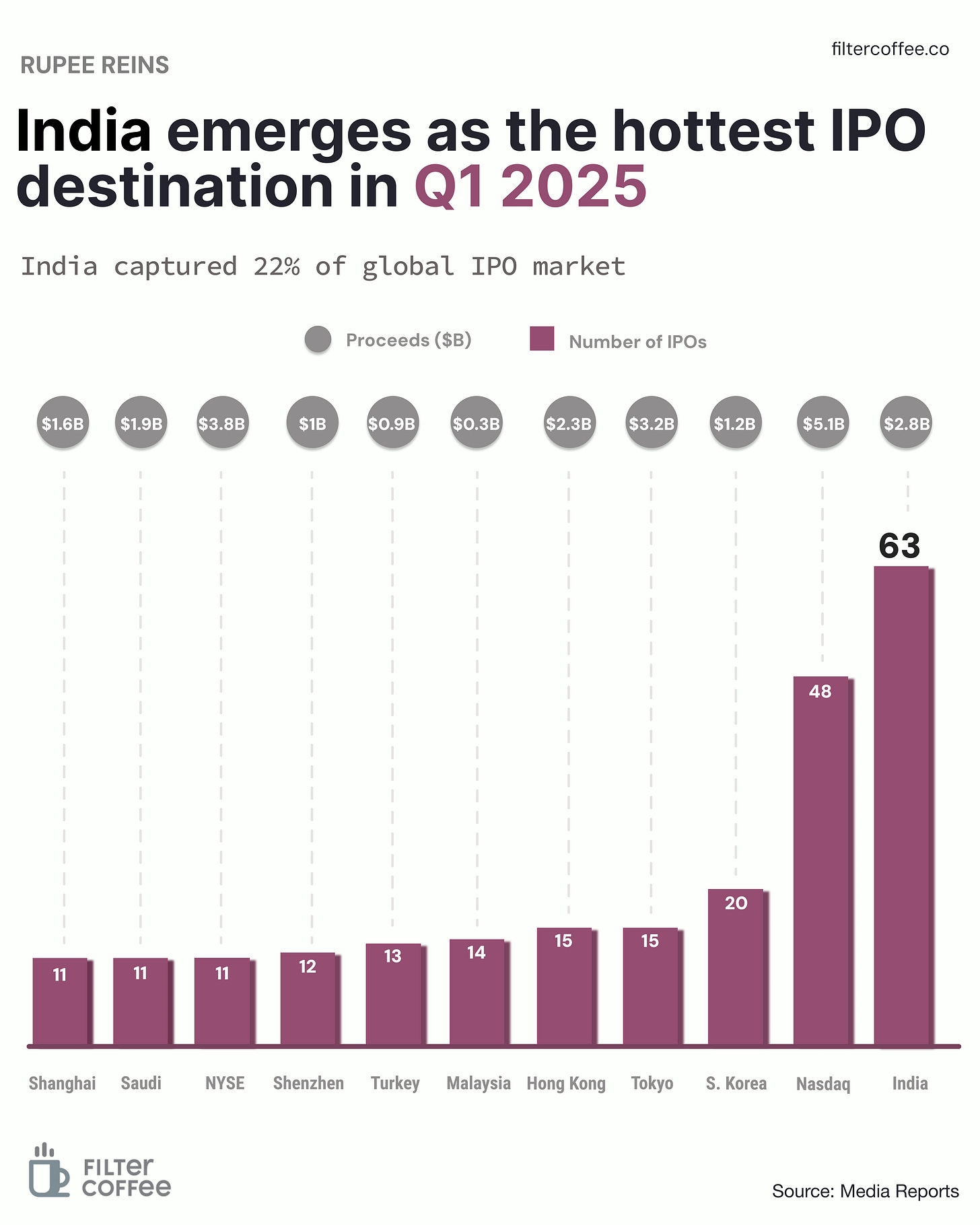

3. Indian IPOs take the global stage 📈

While global markets stayed cautious in Q1 2025, India went the other way, leading the world in IPO activity.

The deets: between January and March, India saw 62 IPOs raise $2.8 billion. This showed that investor appetite is alive and well, even as global markets stay jittery.

2024’s Blockbusters like Hyundai Motor’s ₹27,870 crore debut which was India’s biggest ever and Waaree Energies helped set the tone. Moreover, Hexaware Technologies’ $1 billion raise broke records for the largest Indian IT IPO, beating even TCS.

The how: India’s IPO boom is being powered by a mix of strong investor interest, simpler rules, and a supportive regulator.

Big theme: over 13 crore demat accounts and rising retail participation is at an all-time high, giving IPOs a strong domestic base.

3. Indian Oil signs $1.4B LNG deal with Trafigura 🛢️

Indian Oil has signed a five-year term contract with commodities giant Trafigura to secure liquefied natural gas (LNG) supplies, valued at $1.3–1.4 billion.

The deets: the deal covers around 2.5 million tonnes of LNG. The move is part of India’s broader push to lock in long-term energy security.

What’s happening: India currently imports about 45% of its annual LNG requirement. While Russian crude has played a key role in recent years, its share in Indian Oil’s portfolio dropped to 22% in FY25, down from 30% in FY24, amid new sanctions and supply hurdles.

Zoom out: as India pushes for cleaner and more secure energy sources, long-term LNG deals like this one give Indian Oil stability in a volatile global market. With crude supply from Russia under pressure and refining margins tightening, locking in gas at predictable prices is as much about strategy as it is about survival.

4. Stocks that kept us interested 🚀

1. Vishal Mega Mart’s profit cart overfloweth

Vishal Mega Mart just dropped a blockbuster Q4, with net profit zooming 88% year-on-year to ₹115.1 crore. The investors loved the results and the stock ended 10% higher on Wednesday.

The deets: Vishal Mega Mart is a value-focused retail chain that sells affordable clothing, groceries, and household essentials under one roof. It has built a stronghold in Tier 2 and Tier 3 cities.

By the numbers: revenue grew 23% YoY to ₹2,547.9 crore in Q4 FY25, while margin expanded to 14%, up from 12.1% a year ago.

Why it matters: strong earnings were driven by higher footfall, improved product mix, and deeper reach into Tier 2 and Tier 3 cities, where demand for affordable essentials continues to rise.

What else are we snackin’ 🍿

💸 Ambani ascends: Mukesh Ambani is back in the $100 billion club, with his net worth hitting $106.1 billion as of April 30.

🛡️ Tariff truce: President Donald Trump said that tariff negotiations with India are “coming along great,” and he thinks the U.S. will strike a trade deal with the country.

🏭 Factory freeze: China’s factory activity slumped to a near two-year low in April.

🎧 Pod play: Foxconn has started making Apple AirPods in Hyderabad for export.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.