Google's earnings, Maruti's slowdown, and Infra deals.

🗓 Morning, folks!

It’s officially "step outside and instantly regret it" season in India. 🔥

Hope you're staying cool (and hydrated).

Meanwhile, India's forex reserves are heating up too—rising for the seventh straight week. They jumped $8.3 billion to hit a six-month high of $686.1 billion as of April 18.

The reserves have now climbed $47.5 billion in seven weeks, just $19 billion short of breaking the all-time record set last September.

Why it matters: With global tensions and trade jitters in the mix, the RBI’s got more ammo to keep the rupee steady.

Let’s dive in!

1 Big Thing: Google still got the juice 💰

Earnings season is here and Alphabet just dropped some serious numbers to kick off 2025.

Revenue jumped 12% year-over-year to $90.2 billion, while net income surged 46% to $34.5 billion, blowing past Wall Street expectations.

All of this despite ChatGPT actively eating away at Google’s search share, which generally shows how under-monetised the Google Search experience has historically been.

The deets:

- Core search and ads revenue grew 10% to $50.7 billion.

- YouTube Ads brought in $8.93 billion, up 10.3% YoY.

- Google Cloud revenue soared 28% to $12.3 billion.

- Total ad revenue hit $66.9 billion, up 8.5% from last year.

Some AI success: investors loved to hear that Google’s AI Overviews tool in search now reaches 1.5 billion users monthly—up from 1 billion just six months ago.

The company also announced a $70 billion share buyback and hiked its dividend by 5%.

A buyback is when a company buys its own shares from the market. When that happens, there are fewer shares left—kind of like splitting a pizza among fewer people, so everyone’s slice gets bigger (and more valuable).

Zoom out: Wall Street was waiting for such a rosy earnings report after tariff noise had driven the market crazy. All large tech companies saw stocks get a quick bump on Friday.

Quick note: Alphabet is playing offense. It’s planning a $75 billion investment into AI and infrastructure this year and just bought cybersecurity firm Wiz for $32 billion to fortify its enterprise game.

Quick check-in at home 🇮🇳

Maruti Suzuki posted weaker-than-expected earnings for the January-March quarter, but sweetened the deal for shareholders with its highest-ever dividend.

Revenue rose 6.4% YoY to ₹40,674 crore, but net profit dipped 4.3% to ₹3,711 crore, as rising costs weighed on margins despite two price hikes earlier this year.

Zoom out: even as dividends rise, Maruti’s vehicle sales growth is flattening—hinting rising pressures and shifting consumer tastes.

2. iPhone might go from made in China’ to ‘made in Chennai’ 🇮🇳

Apple is planning to produce every iPhone sold in the US to be assembled in India by 2026.

The deets: that means over 60 million iPhones annually could roll out of Indian factories by the end of next year, marking Apple’s biggest manufacturing shift in decades.

This is a step-up from current operations, where India handled only a fraction of US-bound iPhones. Now, Tata and Foxconn's Indian units are being tapped to take over the full load.

The why: Trump’s tariff tantrum is no joke. Chinese electronics face import duties of up to 100%, and even smartphones carry a 20% duty when shipped to the US.

But this shift has less to do with that and more to do with the fact that making things in China is simply not a good bet for serious companies, as US China relations continue to sour.

In Q1 2025, India shipped over 3 million iPhones, even as the local smartphone market shrank.

Foxconn alone exported $1.31 billion worth of Apple devices in March, taking its year-to-date US shipments to $5.3 billion.

Big picture: Apple’s not alone, Samsung is also considering shifting smartphone production from Vietnam after a 46% tariff blow, and Google's Pixel line may soon be Made in India via partners like Dixon and Foxconn.

3. India may allow foreign ownership in nuclear plants 🤝

India may soon allow foreign companies to own up to 49% in nuclear power plants, marking the first real crack in one of its most tightly controlled sectors.

The deets: as of now, India’s nuclear power industry is a full-blown government monopoly, run by the Department of Atomic Energy through Nuclear Power Corporation of India Limited (NPCIL).

Private and foreign investment is banned because nuclear energy is tied closely to national security. Moreover, Atomic Energy Act of 1960 keeps it strictly under state control.

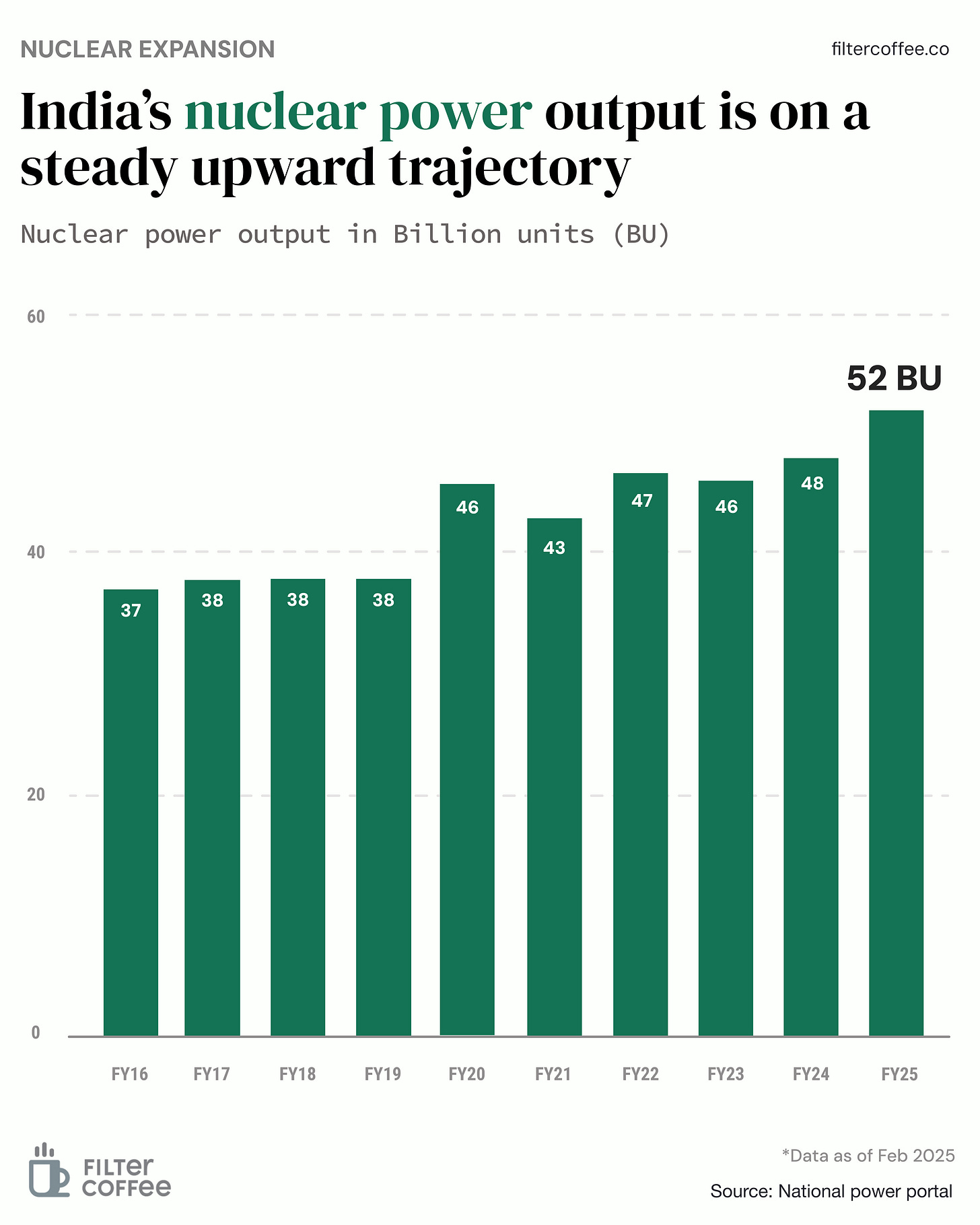

Why it matters: India plans to scale its nuclear capacity 12x to 100 GW by 2047, up from just 8 GW today. But public funding won’t be enough. With coal fading and solar needing night-time backup, nuclear is the missing piece—and opening the sector to private and foreign investment could speed up the transition.

Why now: this shift is unfolding against the backdrop of rising US–China trade tensions and Trump’s tariff storm.

With tariff tensions rising, India is looking to deepen energy ties with the US. Opening nuclear power to foreign investment—especially for American firms—could become a key bargaining chip in trade talks.

Meanwhile, India’s nuclear power generation has been quietly gaining momentum—laying the groundwork for its 100 GW ambition.

4. Stocks that kept us interested 🚀

1. Patel Engineering charges ahead

Patel Engineering has bagged multiple infrastructure projects worth ₹2,036.8 crore.

The deets: Patel Engineering is a Mumbai-based infrastructure company known for delivering hydro power, dam, tunnel, and irrigation projects across India.

Quick project breakdown:

- HEO Hydro Project (Arunachal Pradesh): ₹718 crore contract for a 240 MW plant, expected to generate 1,000 million units annually.

- Kondhane Dam (Maharashtra): ₹1,319 crore contract to build a major dam using advanced Roller Compacted Concrete tech.

Why it matters: on average, one Indian household uses about 1,000–1,200 units of electricity per year. So, this project could power around 8–10 lakh homes every year. The initiative will also support clean, renewable energy, unlike coal, hydro power doesn’t cause pollution.

The update lifted the stock by over 1%.

5. Canara Robeco MF eyes an IPO 📈

Another asset manager is lining up for the IPO runway.

Canara Robeco Asset Management Company, the investment manager for Canara Robeco Mutual Fund, has filed for an initial public offering (IPO) with Sebi.

The deets: the IPO is a pure offer for sale (OFS) by its two owners — state-run Canara Bank and Japan’s Orix Corporation. Canara holds 51%, and Orix owns 49%.

Canara Robeco MF is the 17th largest fund house in India, managing ₹1 trillion in assets as of Q4 FY25.

Why it matters: Pure-play asset managers are rare on Indian exchanges. Only HDFC AMC, Nippon Life India, Aditya Birla Sun Life, and UTI AMC are publicly listed today — and the last AMC IPO (ABSL) happened back in 2021.

Founded in 1993, Canara Robeco is the second-oldest mutual fund in the country — and it’s looking to tap a growing investor base hungry for equity, debt, and hybrid funds.

What else are we snackin’ 🍿

🛢️ Petro push: Reliance Industries Ltd (RIL) plans to invest Rs 75,000 crore ($9 billion) each into its new energy business and petrochemical expansion.

🚀 Fund rush: Peak XV Partners is planning to raise around $1.2 to $1.4 billion for its first fund since splitting from Sequoia.

✈️ Jet juggle: Air India is in talks to buy around 10 Boeing 737 MAX jets, as Chinese buyers back out amid US-China trade tensions.

💼 Samsung splash: Samsung will invest ₹1,000 crore in its Tamil Nadu facility.

🚗 Layoffs: Cars24 has laid off around 200 employees from various departments, including product and technology, as part of a strategic pullback from certain projects,

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.