Amazon's nuclear bet, Defence raises, and SIP inflows hit record high

🗓 Morning, folks!

Markets stayed largely flat on Tuesday after a day of being stuck in a narrow range. Sensex dipped 0.7%, while the Nifty eked out a small gain, marking its fifth straight winning session.

💡 Spotlight: Get ready for a new way the government will track how prices are rising in India.

Starting in early 2026, the official measure of inflation, called the Consumer Price Index (CPI) will be updated to better reflect how people actually spend money today.

One big change: instead of looking at per-unit electricity rates, the new CPI will now consider your whole electricity bill including any subsidies and extra charges since many states offer free or discounted power.

For the first time, the new CPI will also include rural housing costs and track how much people spend on online services like Netflix, train and flight bookings.

This update will give a more accurate picture of everyday expenses for Indians, helping the government and businesses make better decisions about prices, wages, and economic planning.

Let’s hit it!

1 Big thing: ICICI Prudential AMC kicks off mega IPO 📈

ICICI Prudential AMC, India’s second largest asset manager, has kicked off its long-awaited IPO process, tapping a record 17 investment banks to run the deal.

The deets: the 26-year-old JV between ICICI Bank (51%) and UK’s Prudential Plc (49%) is planning a pure offer for sale (OFS) with Prudential offloading shares, and no new capital from ICICI Bank.

The draft papers are expected to be filed by end-June or early July. The IPO size is likely to be around ₹10,000 crore, though the final call is yet to be made.

Zoom out: this would be one of India’s biggest-ever AMC IPOs and the first in years at a time when mutual fund AUMs and retail participation are hitting fresh highs.

With SIPs also at record levels and market sentiment strong, ICICI Prudential AMC is looking to ride the boom with a well-timed market debut.

2. Amazon plugs into nuclear power with $20 billion investment ☢️

Amazon is investing $20 billion to build two data centre complexes in Pennsylvania, one of them tapping directly into a nuclear plant.

The deets: one data centre will rise next to Susquehanna nuclear power plant, where Amazon plans to plug in for power via a special "behind the meter" connection. The other complex will be built at Fairless Hills, on the former site of a US Steel mill, and powered through the regular grid.

Worth noting: this is the largest private investment in Pennsylvania’s history.

The state will likely offer tens of millions in incentives to secure the deal, and the government will also spend $10 million on training programs to build a skilled workforce for the centres.

Why it matters: the AI boom and cloud computing are driving huge demand for energy-hungry data centres. These centres need constant power to run servers, storage, and cooling systems 24/7 and nuclear power offers a reliable, clean source.

For Amazon, plugging directly into a power plant can shave years off development timelines, bypass grid congestion, and lock in long-term power supply.

While we are on investments,

Back home, Tata Motors has planned to invest up to $4.1 billion over five years to strengthen its lead in India’s EV market. The company plans to nearly double its lineup from 8 to 15 models, roll out more EVs and CNG cars, and boost in-car tech.

The company is preparing for stricter 2027 emission norms and is targeting EVs to make up 30% of its car sales by 2030.

More on investments,

Jindal Saw rolled out fresh $118 million capex plans to expand its footprint in the Middle East’s iron and steel sector.

The deets: the company’s board has greenlit three international investments aimed at tapping into growing demand in the region’s oil, gas, and water infrastructure markets.

The breakdown:

- Abu Dhabi, UAE: a 100%-owned seamless pipe plant with a capacity of 300,000 tonnes per year to serve the oil & gas sector. Investment: up to $105 million, completion in ~3 years.

- Saudi Arabia (JV with Buhur): a spiral welded (HSAW) pipe plant, with Jindal holding 51% stake. Investment: up to $10 million, timeline ~2 years.

- Saudi Arabia (JV with RAX): a ductile iron pipe facility, with Jindal holding 51% stake. Investment: up to $3 million, completion in 12–18 months.

3. Sanlayan powers up defence play 💰

Aerospace and defence startup Sanlayan Technologies has raised ₹186 crore in its latest Series A round to ramp up its growth and capabilities.

The deets: founded by ex-Zetwerk employees, Sanlayan builds advanced electronic systems, think radar, electronic warfare, and mission-critical aviation electronics for defence and aerospace.

Sanlayan also recently acquired a majority stake in Dexcel Electronics, a 20-year-old embedded systems firm that has contributed to major programs like Jaguar, Sukhoi, LCA Tejas, and Chandrayaan-3.

Why it matters: the company is gunning for deep indigenisation in India’s strategic sectors. It’s already working on an Active Electronically Scanned Array (AESA) radar for the country’s unmanned underwater vehicle (UUV) program and with Dexcel’s expertise in the fold, it aims to scale faster in defence, aerospace, and space markets.

While we are on fundraises,

Mobility startup Rapido is raising ₹125 crore from Nexus Ventures in its Series E round, valuing the firm at $1.1 billion.

The funding comes as Rapido gears up to enter food delivery, with a new platform that charges restaurants a flat fee per order, setting the stage for a showdown with Swiggy and Zomato.

On May 24, Rapido claimed to hit a record 4 million rides in a day, while currently averaging 3.5 million daily rides.

4. Stocks that kept us interested 🚀

1. NIBE bags DRDO bridge deal 🌉

NIBE jumped more than 8% after it bagged a technology transfer license from DRDO for its modular bridging system.

The company is a defence and engineering technology firm that designs and manufactures specialised equipment and solutions for the Indian Armed Forces and government sectors.

The deets: developed by DRDO, the modular bridging system is a high-tech, mobile bridge that can be mechanically launched to let military vehicles cross obstacles quickly, think of it as a giant, portable Lego bridge for the army.

The system can deploy spans between 14 to 46 metres, supporting both tracked and wheeled vehicles in combat zones.

Why it matters: the deal gives the company access to battle-tested tech and a steady pipeline of government orders, a strong win in India’s push for defence indigenisation.

2. BEML bags tank mobility deal 💪

BEML has signed three new deals with DRDO’s Vehicles Research & Development lab to make special vehicles for the Indian Army.

Under the deal, BEML will build two types of maintenance & repair vehicles for the Army’s MBT Arjun tanks, plus an advanced 70-tonne trailer to transport tanks.

These vehicles help move and fix heavy tanks quickly, keeping the Army’s frontline gear ready for action.

The designs and tech will be made fully in India, cutting reliance on imports and boosting local manufacturing.

For BEML, this opens up a steady stream of high-value defence orders in a fast-growing segment.

3. ITD Cementation wins ₹893 crore Odisha jetty deal 🏗️

ITD Cementation ended 6% higher after it bagged a ₹893 crore contract in Odisha. The company will build key parts of a new jetty, including berths and breakwater structures.

This is part of a greenfield port project, meaning it’s being built from scratch.

Breakwaters protect jetties from big waves, while berths are where ships dock and unload.

The deal strengthens its play in marine infrastructure & it is another big step in India’s growing push for better port connectivity and logistics.

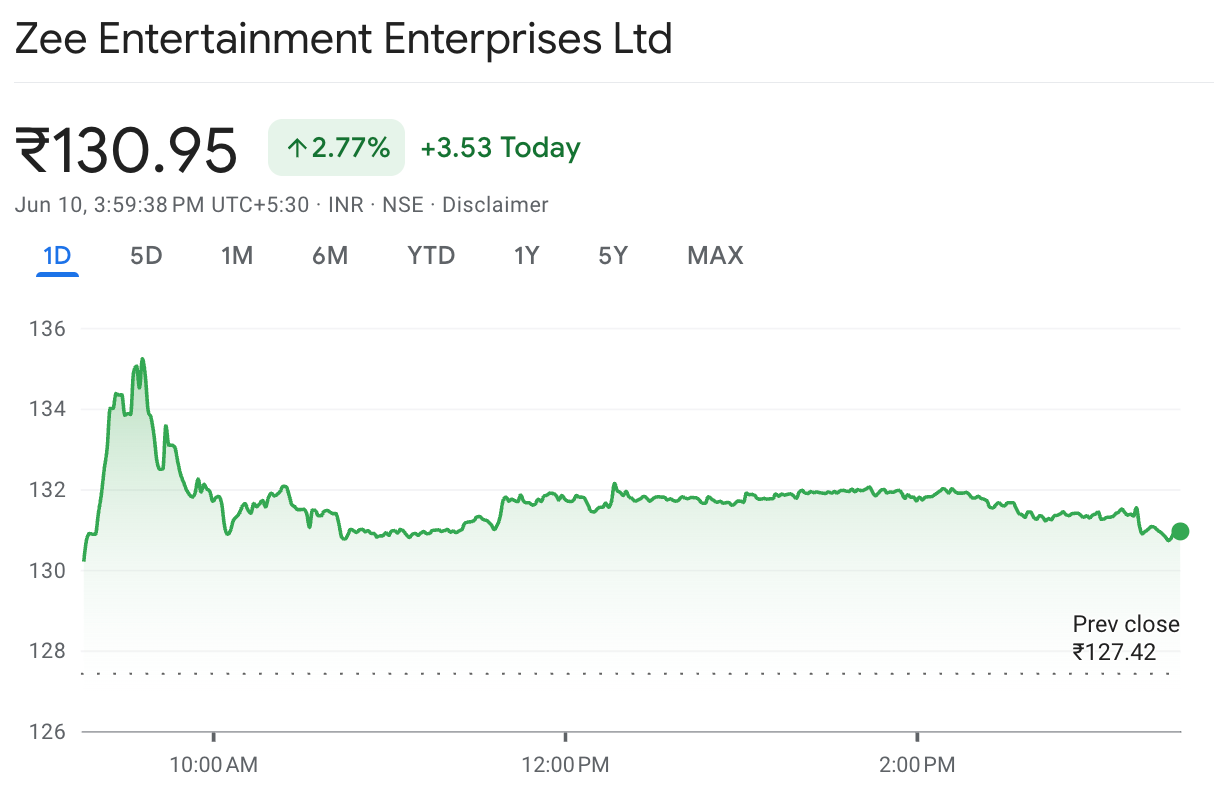

4. Zee bets on micro-drama 🎬

Zee Entertainment gained over 3% after announcing partnership with startup Bullet to launch India’s first micro-drama app.

Micro-dramas are short, creator-driven video stories designed for quick, mobile-first viewing, perfect for younger audiences. Bullet will go live within the Zee5 ecosystem, with content available in multiple languages for wider reach.

The move supports Zee’s strategy to evolve into a content + tech powerhouse, tapping into the fast-growing short-video entertainment market.

6. Story in data: SIP inflows hit record high 📊

SIP contributions hit an all-time high of ₹26,700 crore in May 2025, continuing their steady rise over the past year.

This marks a 25% jump from June 2024, when monthly SIP inflows stood at ₹21,300 crore.

Despite market volatility, Indian investors are doubling down on systematic investing, showing confidence in long-term equity exposure.

SIP flows now account for a large and stable chunk of mutual fund inflows, helping reduce dependence on short-term market sentiment.

With rising financial literacy and easier digital onboarding, retail participation is hitting record levels month after month.

What else are we snackin’ 🍿

🏦 Universal dreams: Jana Small Finance Bank applied to RBI to become a universal bank.

🇮🇳 Made in India: Shein to sell India-made apparel globally in partnership with Reliance, shifting supply away from China.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.