DMart's numbers, Chip Deals, and AI wave.

Morning, folks 👋

📈 Made it through the first week of 2025 and it wasn’t exactly the party we had hoped for.

Global markets are wobbling, crypto remains on shaky ground and Indian markets, although a bit stable, are seeing a rough time in areas like small caps.

But with earnings season kicking off, things could get interesting.

💡 Quick spotlight: India’s M&A activity grew 38% in 2024, touching $109 billion, up from $79 billion last year—a solid vote of confidence in India’s growth story.

🇺🇸 Meanwhile, Trump is gearing up to take office on January 20, which is another critical event on global market calendars.

💰Anyway, easy news day today. Let’s get through it and leave you to better things.

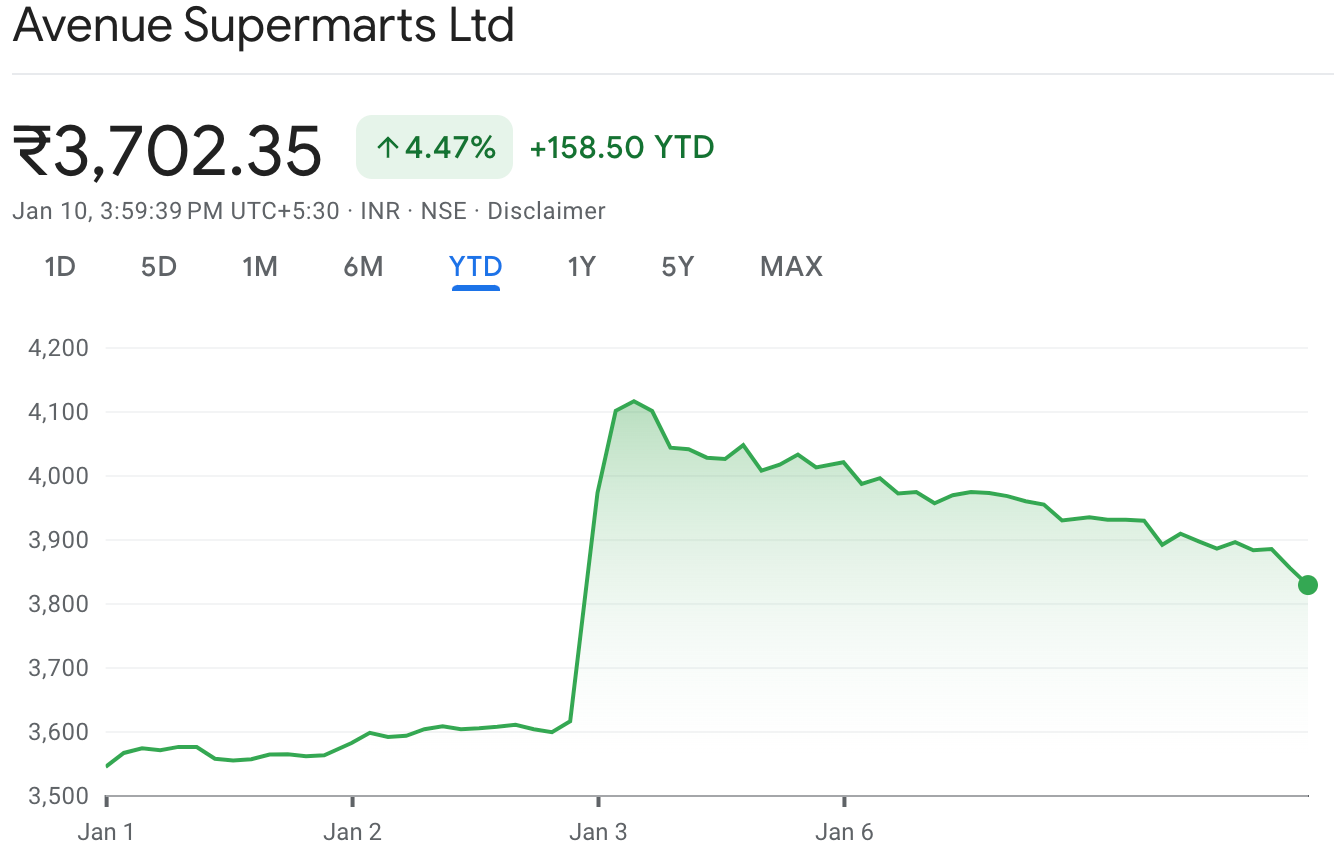

1 Big Thing: Dmart fails to delight 🛒

Earnings season is here, and D-Mart’s momentum is slowing as stiff competition from q-commerce and rising costs hit its business.

Major stats: D-Mart posted a 4.8% rise in profit to ₹724 crore this quarter, with revenue growing 17% to ₹15,973 crore, which isn’t particularly bad but not enough to pacify the markets.

The snag: margins slipped from 5.1% last year to 4.5% this time.

Why it matters: management pointed to intense FMCG discounting as the main culprit, which impacted high-performing metro stores. Same-store sales for outlets over two years old grew 8.3%—a slight recovery but far from remarkable.

D-Mart currently operates 381 stores and is also dipping its feet in online deliveries. Its grocery platform, D-Mart Ready, grew 21.5% in the last nine months, with home delivery now outpacing pick-up points.

Bottomline: India’s retail market, the world’s fourth-largest, is projected to grow to $1.5 trillion by 2030.

While D-Mart remains a strong player, balancing offline dominance with online growth is getting tougher. Rising costs and squeezed margins leave little room for error, especially as Zepto and Swiggy Instamart eat into market share.

Anyhoo, the numbers set a favorable stage for other consumer companies set to report in the coming weeks. ✌️

2. Major emerging tech deals announced 🛠️

Indichip Semi, a domestic semiconductor firm, will join hands with Japan’s Yitoa Micro Technology (YMTL) to build India’s first private silicon carbide (SiC) chip manufacturing facility in Andhra Pradesh.

The deets: The ₹14,000 crore plant will be set up in Kurnool and will produce 10,000 silicon carbide (SiC) chips a month.

Silicon carbide chips (SiC) are used in modern power electronics for high efficiency, high power, and extreme condition applications, including inverters, power components, EVs, industrial motors, control systems, and more.

The company is hoping India’s push to procure semi components locally could be a key driver to its business.

Meanwhile, in Chhattisgarh…

Adani will invest ₹75,000 crore in the state, supporting the build up of projects around power, cement, education, and healthcare.

The deets: Gautam Adani met with Chief Minister Vishnu Deo Sai to lock in the plan. Most notably, this includes expanding power plants in Raipur, Korba, and Raigarh, boosting capacity by 6,120 MW.

Some of the major commitments include:

- ₹5,000 crore investment to boost cement production.

- ₹10,000 crore under the Adani Foundation for education, healthcare, and skill development.

- Plans to explore defence manufacturing, data centers, and a Global Capability Centre in the state.

3. No beer for Telangana 🍺

It’s been a tough week for beer lovers in Telangana.

Heineken-owned United Breweries – India’s largest beer company – halted supplies to Telangana this week.

The deets: the state apparently owes liquor giants like Diageo, Pernod Ricard, and Carlsberg $466 million in unpaid dues.

Why it matters: Telangana is India’s largest beer consumer. It regulates alcohol sales through state-run depots, which means liquor companies rely on the government for payments, which have been delayed since 2019—hurting finances.

United Breweries, which holds 70% of the state’s beer market, pulled the plug, a bold move given Telangana accounts for 15–20% of its annual sales.

Why beer is king: the booming IT industry, a vibrant young population, and a hot climate make cracking open a cold one a routine affair.

Zoom out: India’s alcohol market is no small game—valued at $45 billion annually, it’s the 8th largest in the world and a major revenue source for states.

Continued social liberalization is making the alcohol theme a hot one for investors to play the India consumer story. But archaic rules and over-regulation is deterring the party.

4. Taiwan rides high on AI 📈

Taiwan-based TSMC, the foundry that makes the most advanced chips for companies like NVIDIA, reported a 34% surge in sales to a record $88 billion last year.

Why does this matter: TSMC controls over 50% of the global chip market, powering everything from iPhones to Nvidia’s cutting-edge AI hardware.

The company’s tech and capabilities are so advanced that despite being in a conflicted region of Taiwan, which is at the center of the US-China problems, diversifying away from TSMC is impossible for the world’s largest semi companies.

If you are interested in learning more about their history, here’s a quick summary.

Bottomline: the global semiconductor market was valued at $611 billion in 2023 and is projected to grow to $2.1 trillion by 2032. Giants like TSMC make bank serving this demand.

What else are we snackin’ 🍿

🚗 Fix those cars: Tesla is recalling 239,000 vehicles due to rearview camera issues.

🔌 Luxury EVs rev up: India’s luxury EV market grew 6.7% in 2024, with 2,809 units sold by BMW, Mercedes-Benz India, Volvo Cars, Audi, and Porsche—up from 2,633 in 2023.

📉 Rupee slump: The rupee hit an all-time low of 85.9 against the U.S. dollar, marking its 10th straight week of decline.

🔥 California burns: Wildfires in California are projected to cause $135B–$150B in damages, making it one of the costliest U.S. wildfires ever.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.