Polar Vessel bet, Zydus backs Agenus, and Whiskey market heats up.

🗓 Morning, folks!

Markets wrapped up Thursday on a high, with Sensex & Nifty ending in the Green and broader indices once again outperforming the frontline benchmarks.

The action was hot in QSR stocks, as Swiggy surged 9% and Eternal Foods gained over 3%, riding on upbeat demand trends. HDFC Bank inched up 1% after SEBI cleared the ₹12,500 crore IPO of its lending arm, HDB Financial Services. We broke it down yesterday.

💡 Spotlight: India’s services sector hit a three-month high in May, with the PMI climbing to 58.8, its fourth straight month above the 58 mark.

The key driver? Export demand. New international orders rose at the fastest pace this year, signaling strong global appetite for India’s white-collar services.

1 Big thing: Zydus backs cancer drug disruptor 🧬

Zynext Ventures USA, the VC arm of Zydus Lifesciences, has signed a deal to acquire a 5.9% stake in Agenus Inc.,

The investment will see Zynext purchase 2.13 million shares at $7.50 apiece, with the acquisition to be wrapped up in cash within 60 days.

Why it matters: Agenus is betting big on next-gen cancer drugs specifically Botensilimab (BOT) and Balstilimab (BAL), a powerful immunotherapy combo that’s already shown strong results across 9 cancer types in 1,200+ patients.

Zydus will bring in analytics chops, regulatory depth, and a global biotech network to the table which could help Agenus fast-track trials and expand indications.

For Zydus, it’s a strategic move to deepen its global biopharma presence and tap into high-potential cancer treatments that could reshape how solid tumors are tackled.

Zoom out: with a 2024 turnover of $103 million, Agenus is small but a serious player in the checkpoint inhibitor and cell therapy space. The deal comes as Indian pharma majors like Zydus aim to go beyond generics and become serious innovation players on the global stage.

While we are on acquisitions,

Tilaknagar Industries is eyeing its biggest move yet, snapping up Imperial Blue from Pernod Ricard in what could be liquor’s biggest deal in two decades.

The deets: Tilaknagar has edged out rival Inbrew Beverages to become the frontrunner for acquiring Imperial Blue, one of India’s top-selling whisky brands. The deal, estimated at ~$600 million, would mark the biggest M&A in India’s alcobev space since Diageo’s $1.9 billion United Spirits takeover in 2013.

Why it matters: Tilaknagar, known for Mansion House brandy, wants a bigger bite of the premium whisky pie. Imperial Blue would give it instant scale in the crowded mid-segment whisky market. And it’s got momentum—Q4FY25 profit jumped 146% YoY to ₹77.4 crore, while revenue rose 13%.

2. Hyundai exits Ola Electric 📉

Hyundai has offloaded its entire 2.47% stake in Ola Electric, while Kia trimmed its holding, cashing out ~$80 million just as Ola’s challenges mount and stock slides.

Hyundai’s shares were sold at ₹50.7 each, and Kia’s at ₹50.5, both at around a 6% discount to the previous close.

Why it matters: back in 2019, Hyundai and Kia had pumped $300 million into Ola Electric, with plans to jointly develop EVs and charging infra.

The stake sale signals that global backers are growing cautious, especially as Ola faces regulatory heat, shrinking margins, and rising competition from established automakers.

The EV startup’s stock is now down 46% since its August 2024 IPO, a tough ride for a company once pitched as India's EV poster child.

Zoom out: for Hyundai, this is part of a bigger realignment. The company is scrambling to deal with US tariffs, forming a task force, and shifting some vehicle production from Mexico to the US.

Hyundai and Kia are the world’s third-largest automakers & these companies rely heavily on US sales, with two-thirds of their US volumes being imports. They’ve announced a $21 billion investment in US operations, including a massive EV factory in Georgia.

The shift from Ola might just be Hyundai choosing to double down at home and ditch what’s no longer core to its global EV game plan.

3. Stocks that kept us interested 🚀

1. Garden Reach bags polar vessel deal 🛳️

Garden Reach Shipbuilders signed an MoU with Norway’s Kongsberg to build India’s first-ever Polar Research Vessel.

A Polar Research Vessel is a special ship that helps scientists travel through ice and study the Arctic and Antarctic regions.

The deets: the vessel will be constructed at Garden Reach’s Kolkata shipyard and developed in collaboration with the National Centre for Polar and Ocean Research, which will use it for missions in the Arctic, Antarctic, and southern oceans.

The MoU gives Garden Reach access to global polar ship design expertise while drawing on its own experience building complex warships and research vessels.

Why it matters: this marks a big step in India’s scientific and strategic push into the polar regions. Currently, India rents foreign vessels for its missions but this deal will help build self-reliance in extreme-weather exploration.

2. KEC International wins ₹2,211 crore in global orders 💰

KEC International just bagged fresh orders worth ₹2,211 crore across power, oil & gas, and infra segments.

The deets: the biggest win came from its transmission and distribution (T&D) business. KEC has bagged a large order in Saudi Arabia to design, supply, and install 380 kV overhead power transmission lines which is a crucial part of the country’s growing power infrastructure.

It also secured T&D supply orders in the Americas, including a big one from Mexico via subsidiary SAE Towers, strengthening its Latin America foothold.

KEC also picked up its second oil & gas contract in Africa, this time for terminal station works, and fresh cable orders in both India and export markets.

Big picture: from Riyadh to Rio, KEC’s global playbook is working. These wins highlight its rising relevance in powering infrastructure across borders.

4. Story in data: India’s AI moment 📊

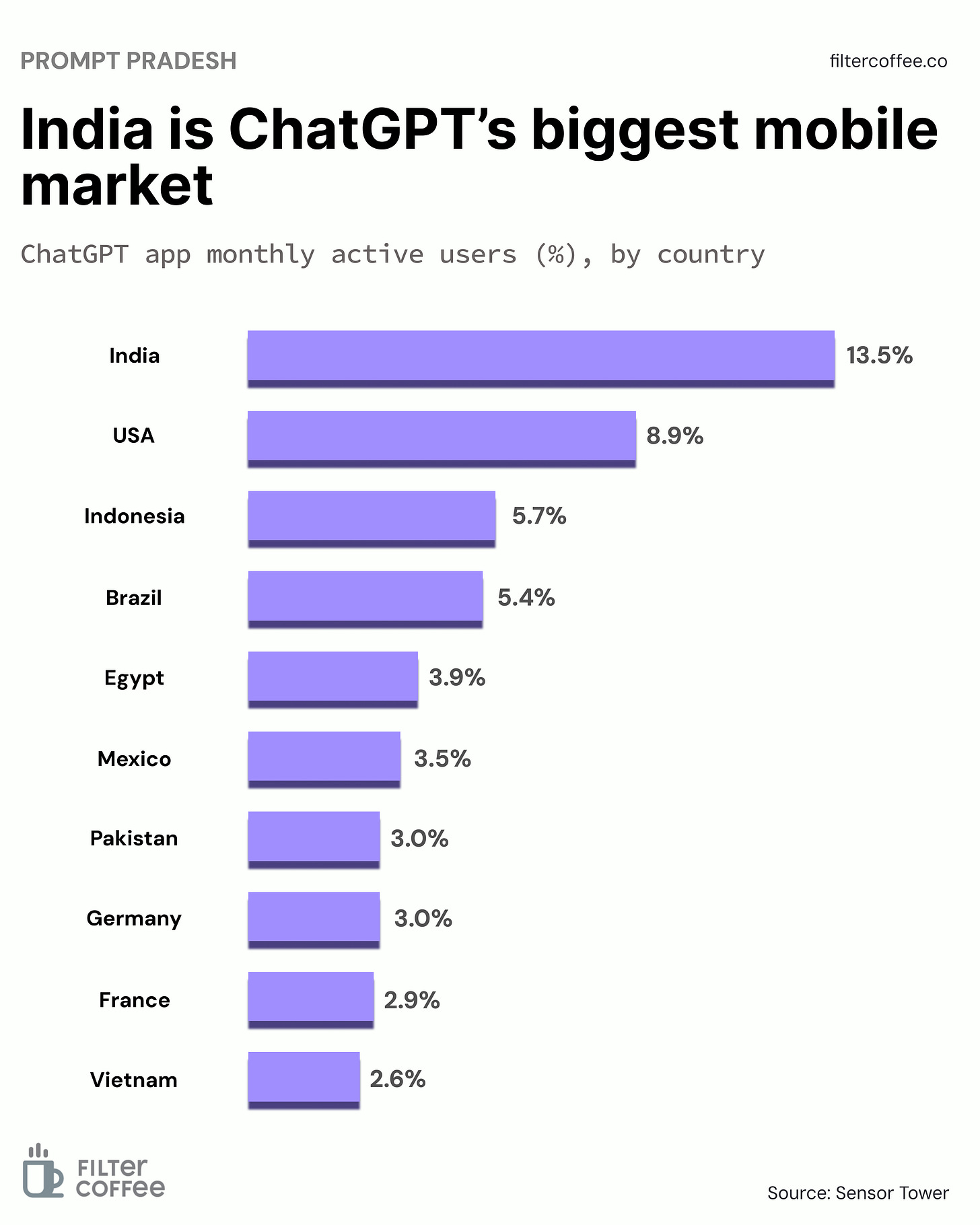

India has officially dethroned the US as ChatGPT’s largest mobile user base, accounting for a whopping 13.5% of all monthly active users globally. The US trails behind at 8.9%, followed by Indonesia and Brazil.

That surge is powered by India’s mobile-first digital economy, where over 800 million internet users are now experimenting with AI tools via their phones.

While most Western markets remain desktop-heavy, India’s ChatGPT use is shaped by younger, digital-native users accessing bite-sized help in education, coding, and job prep.

The surge is so sharp that OpenAI is now eyeing a data centre in India to handle the traffic and bring data storage closer to home.

What else are we snackin’ 🍿

💻 Chip king: Nvidia is now the world’s most valuable listed company, topping Microsoft with a $3.5 trillion market cap.

🕒 IPO pause: Zepto has delayed its IPO plans by a year and now aims to go public in 2026.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.