More IPOs, Nuclear deals, and A mega fundraise.

🗓 Morning, folks!

Markets hit the brakes on Tuesday. The Sensex dropped nearly 2%, while the Nifty slid 1.5% as global jitters weighed on sentiment. Investors are bracing for a potential tariff move from the US, expected later today.

💡 Spotlight: UPI closed the year with a bang

India’s digital payments system had its best month yet. In March, UPI processed ₹24.8 lakh crore across 18.3 billion transactions setting a new record.

That’s 11 straight months above ₹20 lakh crore, with value up 25% and volume up 36% year-over-year.

Let’s hit it!

1 Big Thing: ITC makes a paper play 💰

ITC is acquiring Century Pulp and Paper from Aditya Birla Real Estate Ltd in a ₹3,498 crore deal. This is one of ITC’s biggest industrial bets yet.

The deets: Century Pulp and Paper manufactures tissue, board, packaging, and hygiene-grade paper products.

The why: with this deal, ITC gets a 60% jump in its paper manufacturing capacity, taking it from 8 lakh to 12.8 lakh metric tonnes per annum.

ITC already operates four paper facilities, all located in South India. Century’s unit in Lalkuan, Uttarakhand helps diversify its manufacturing footprint into North India.

By the numbers: in FY24, Century clocked ₹3,375 crore in revenue, while ITC’s paper and packaging vertical brought in ₹8,344 crore—12.6% of the conglomerate’s overall revenue last quarter.

Backstory: while ITC is best known for cigarettes and FMCG, paper has quietly become one of its most profitable verticals. It’s also one of the few companies in India with an integrated pulp-to-packaging operation, and this deal fits neatly into that strategy.

For Aditya Birla Real Estate, the sale frees up capital and lets the company focus squarely on its core business.

Zoom out: India is the world’s fifth-largest paper producer, generating over ₹80,000 crore in annual turnover. Demand is rising 6–7% a year, but growth is skewed toward packaging and hygiene, not printing. ITC is clearly placing its chips on the right side of that equation.

2. OpenAI raises a historic $40 billion round 💪

OpenAI just locked in a massive $40 billion funding round, making it the largest private tech fundraise in history.

The deets: the new capital values the ChatGPT-maker at $300 billion.

SoftBank is leading with a $30B commitment, joined by Microsoft, Coatue, Altimeter, and Thrive. A big chunk, around $18B, is expected to fuel OpenAI’s Stargate project, which focuses on building next-gen computing infrastructure for AI.

The company now has 500 million weekly users and plans to triple its revenue to $12.7B this year.

- Worth noting: the valuation puts OpenAI behind only SpaceX at $350 billion.

3. Quick IPO in focus 📈

Runwal Enterprises, a Mumbai-based real estate developer, filed draft papers with SEBI for an IPO to raise ₹1,000 crore.

The deets: the company develops residential, commercial, and retail spaces, best known for large-scale townships and premium housing projects across metro cities.

What’s new: the IPO is a fresh issue, with an option for a ₹200 crore pre-IPO placement. Proceeds will be used to pare down debt and fund future real estate projects.

By the numbers: Runwal posted ₹662 crore in revenue in FY24, up 189% from last year. It turned profitable with ₹107 crore in earnings, led by strong sales from its flagship Runwal Gardens project.

Key nugget: Runwal ranks second in Mumbai’s new project launches over the last five years.

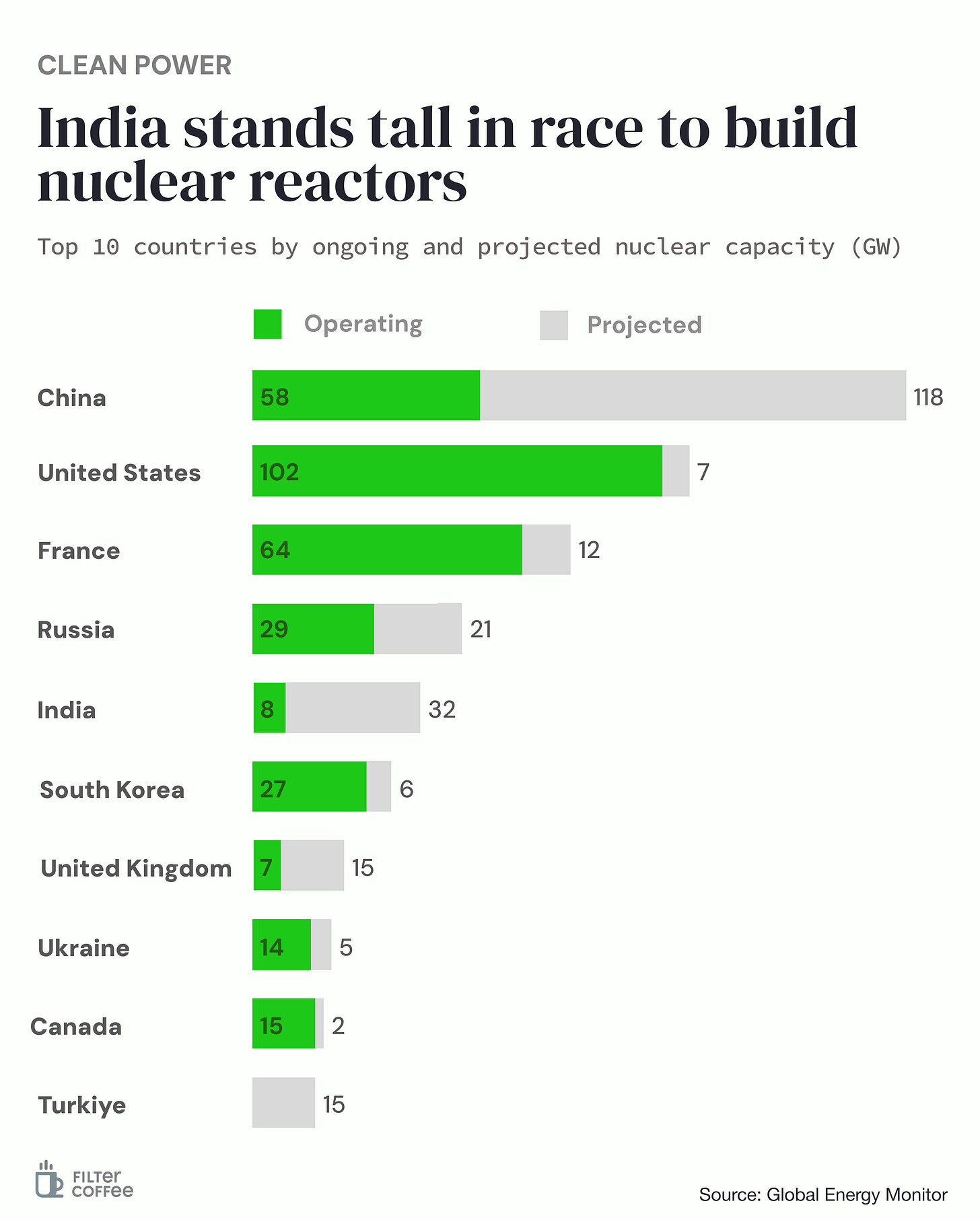

4. India & US go nuclear 🔥

India and the US just unlocked a key milestone in nuclear energy cooperation, with Washington greenlighting tech transfer for Small Modular Reactors (SMRs).

SMRs are small, modular nuclear reactors designed for safer, more flexible power generation. They require less space, can be built faster, and generally are about the size of a two-story building. They’re expected to play a big role in powering AI data centers.

Holtec International, a US-based nuclear specialist, received approval from the Department of Energy to share its SMR technology with India. It will work with Holtec Asia, L&T, and Tata Consulting Engineers to co-develop reactors locally.

This marks a breakthrough in the long-stalled Indo-US Civil Nuclear Agreement, signed way back in 2007. Until now, American firms were barred from designing or manufacturing nuclear plants in India.

The deal comes weeks after PM Modi and President Trump met to push forward clean energy collaboration.

Why it matters: India currently gets just 1.8% of its power from nuclear energy.

5. Stock that kept us interested ⚡

1. Sterling & winning

Sterling and Wilson shares surged nearly 7% after bagging new orders worth ₹1,470 crore across solar and hybrid projects.

The deets: the company is a homegrown engineering firm best known for building large-scale solar power projects. It also works in data centers and other infra spaces, and is globally ranked among the top solar Engineering, Procurement, and Construction players.

The company just landed three new clean energy projects-

- Two domestic orders from private power producers

- One where it's been declared L1 bidder for a 200 MW solar project.

The project marks Sterling’s first-ever entry into Wind EPC via a hybrid project.

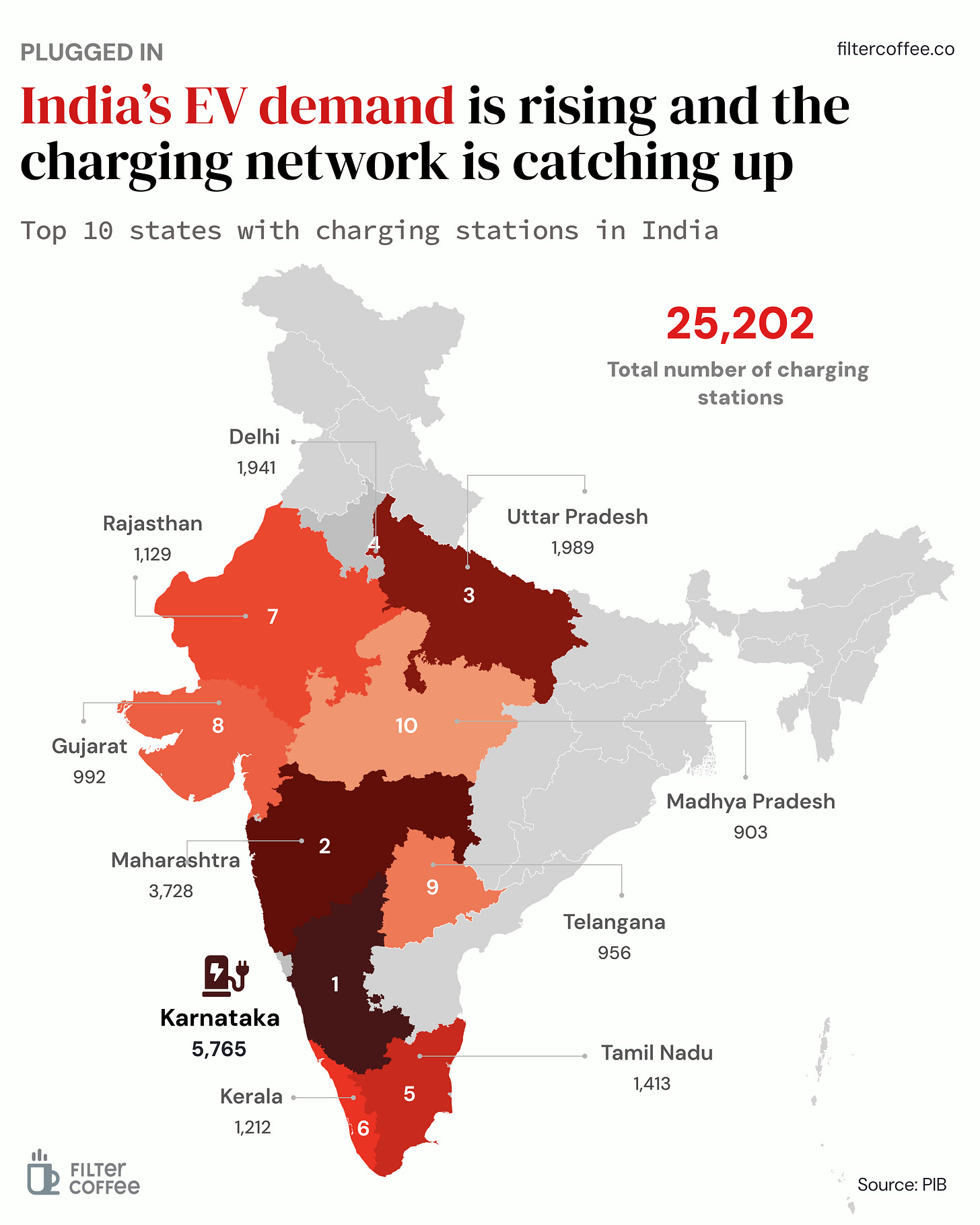

6. Story in data: Plugged in 📊

India now has over 25,000 EV charging stations, with Karnataka, Maharashtra, and Tamil Nadu leading the charge.

Karnataka alone hosts more than 5,700 stations, cementing its spot as India’s EV powerhouse.

But for widespread transition, rural coverage and fast-charging access still lag behind.

What else are we snackin’ 🍿

⚡ EV shuffle: Ola Electric clocked 23,430 registrations in March, but slipped behind Bajaj and TVS in monthly EV sales.

💸 GST boom: March GST collections hit an 11-month high at ₹1.96 lakh crore, up 10% from February’s ₹1.84 lakh crore.

🏦 LIC slips: LIC has dropped out of India’s top 10 most valuable listed companies, with the stock down 11% in 2025.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.