Pepsico likes chakna, A Neuroscience bet, and Layoff's are back.

🗓️ Morning, folks 👋

📈 Another steady and positive day in the markets, with the Sensex rising 0.29% and Nifty adding 0.16%, despite broad market uncertainties looming.

💡 Quick Spotlight: India’s trade deficit narrowed to $21.9 billion in December, a sharp drop from November’s record $31.8 billion, thanks to gold imports halving to $4.7 billion.

Another positive was that electronics exports surged 35%, hitting a 24-month high of $3.5 billion.

But before you take a victory lap, consider this: China saw a $1 trillion trade surplus for 2024, a historic high for any nation in the history of humanity.

Let’s hit it!

1 Big Thing: Israel and Hamas reach ceasefire deal 🤝

Israel and Hamas agreed to a ceasefire and the release of hostages. This brings an end to 15 months of brutal conflict.

The deal was confirmed by mediators in Qatar after weeks of intense negotiations, pushed for by Trump.

Backstory: the conflict began in October 2023 when Hamas launched a surprise attack on Israel, killing 1,200 people and taking 253 hostages.

Israel’s retaliation almost destabilized the region, inviting responses from other nations, in the process displacing hundreds of thousands of people and killing thousands.

What’s next: mediators presented the final terms earlier this week, with input from U.S. Secretary of State Antony Blinken and Trump’s Middle East envoy pick, Steve Witkoff.

Say what you may, the deal playing out days before Trump assumes office secures a big win for the Pres before he takes charge, likely setting the dominant tone for his middle east policy.

Looking ahead: while the ceasefire offers a temporary reprieve, the region’s broader political and humanitarian crisis remains unaddressed.

2. PepsiCo wants that chakna 🥜

At the moment, Haldiram’s operation is just as hot as its chakna.

Moneycontrol says, PepsiCo is in talks to acquire a 10–15% stake in Haldiram Snacks, trying to outbid Temasek and the others who want the brand.

The deets: Haldiram’s founders, the Agarwal family, is seeking a valuation of ₹85,000–90,000 crore. This would be the company’s first external investment, if it goes through.

Context: India’s snacks market is worth ₹42,695 crore, and expected to grow to ₹95,522 crore by 2032. Haldiram with its vast products and its history clearly dominates this space.

PepsiCo, known for Lay’s and Kurkure, leads the western snacks segment with a 24% share but has struggled in ethnic snacks like namkeen and bhujiya, where Haldiram excels.

PepsiCo has previously acquired Uncle Chipps in 2000 and introduced Doritos nachos in 2016-17.

The deets: PepsiCo’s US executives recently opened discussions with the Agarwal family.

Bottomline: ethnic snacks is also one of the categories that can scale globally, in addition to giving a brand like Pepsi a deeper foothold into the Indian consumer. All out win.

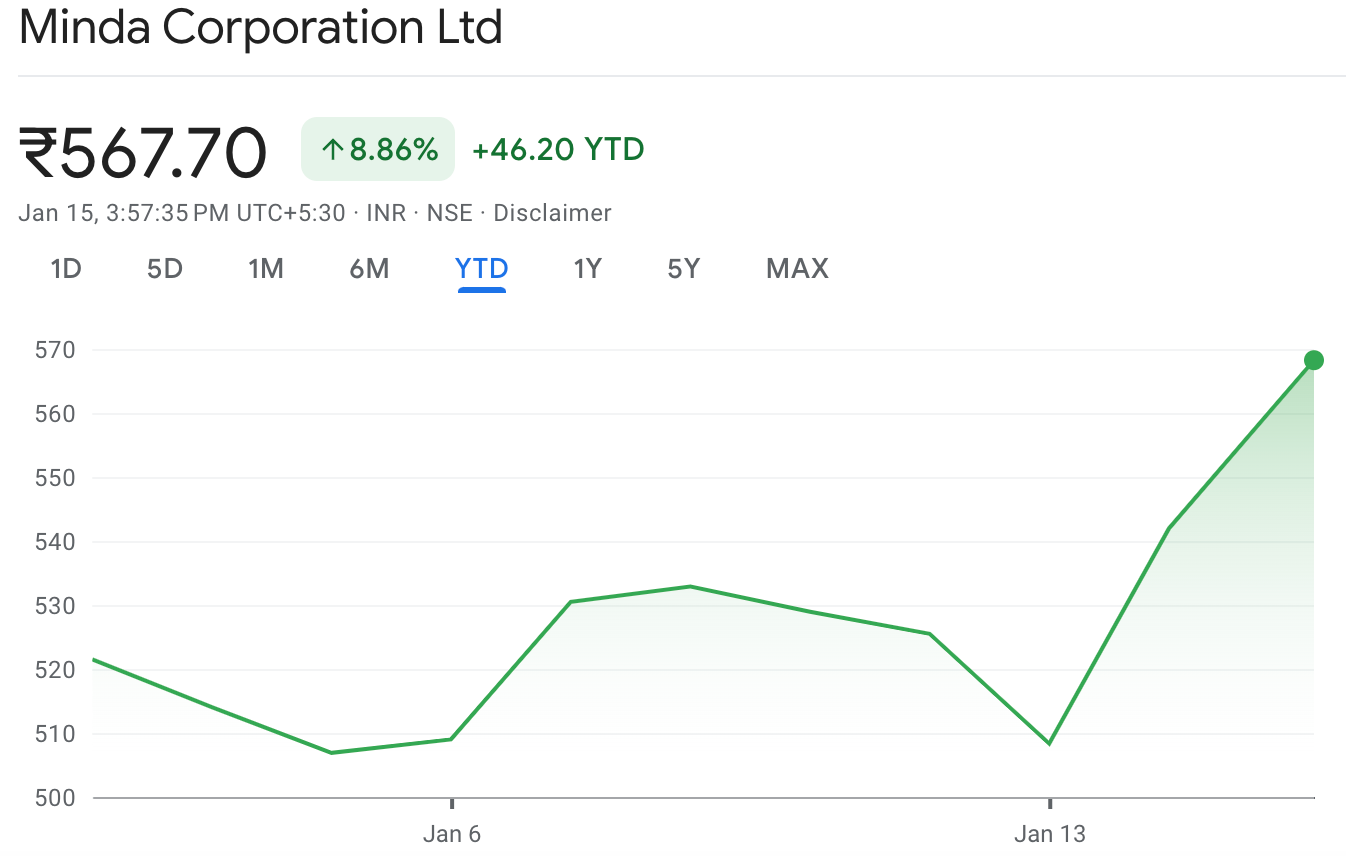

3. Big Daily Movers 🚀

Minda Corporation shares popped nearly 5% after a ₹1,372 crore acquisition of a 49% stake in Flash Electronics.

Flash, a leader in automotive components, is projected to hit ₹1,500 crore in revenue for FY25 with strong margins and a 22% return on capital.

Meanwhile, Minda Corporation is a …

Minda’s stock, already up 43% in the past year, got a further boost as investors cheered the deal.

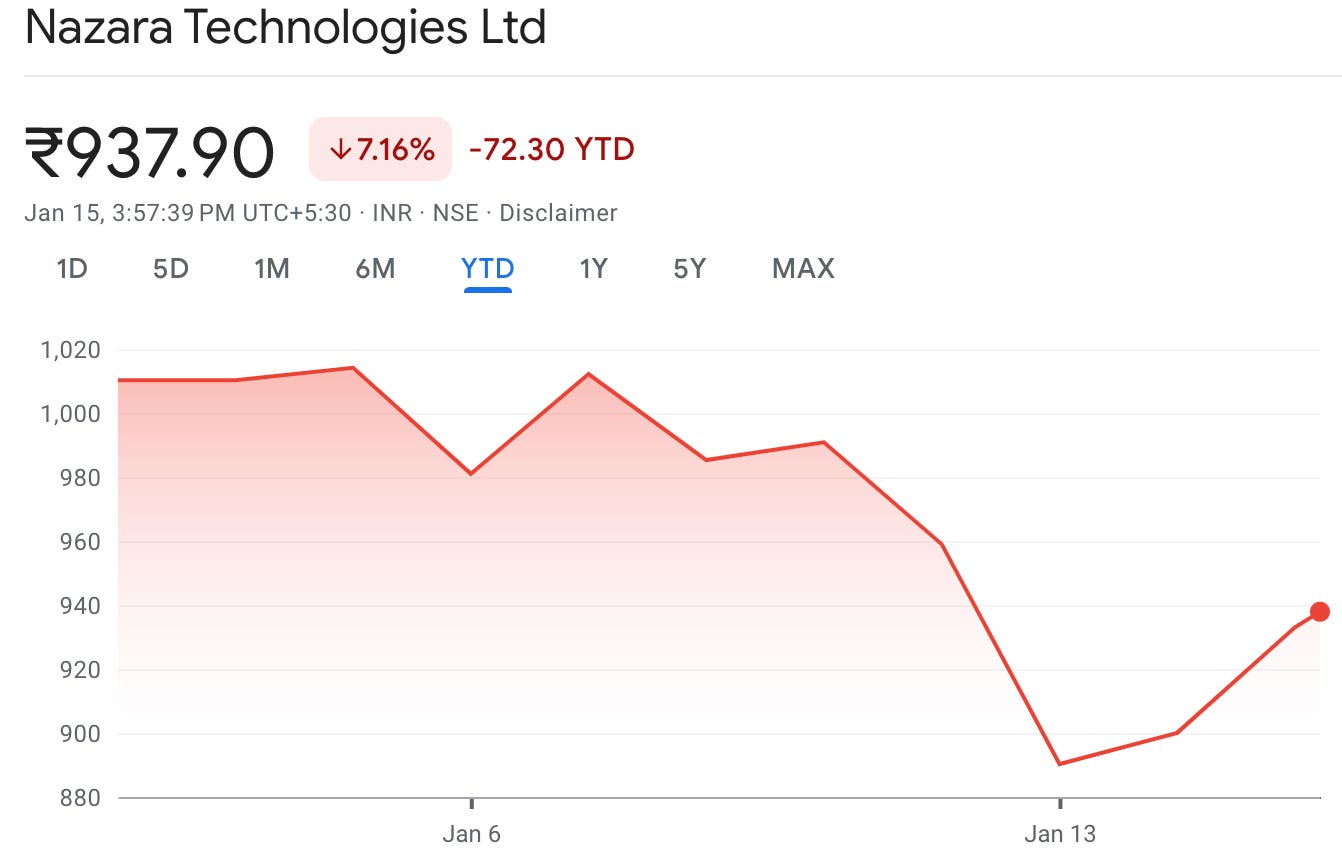

Nazara is diving into reality TV gaming with a Bigg Boss partnership.

Its subsidiary, Fusebox Games, has teamed up with Banijay Rights to turn Bigg Boss into an interactive mobile game, tapping into the show’s massive fanbase and unlocking new revenue streams.

This move aligns with Nazara’s push to diversify its portfolio, which spans e-sports (Nodwin), early learning apps (Kiddopia), and real money gaming (Classic Rummy).

The news lifted Nazara’s stock nearly 5% today.

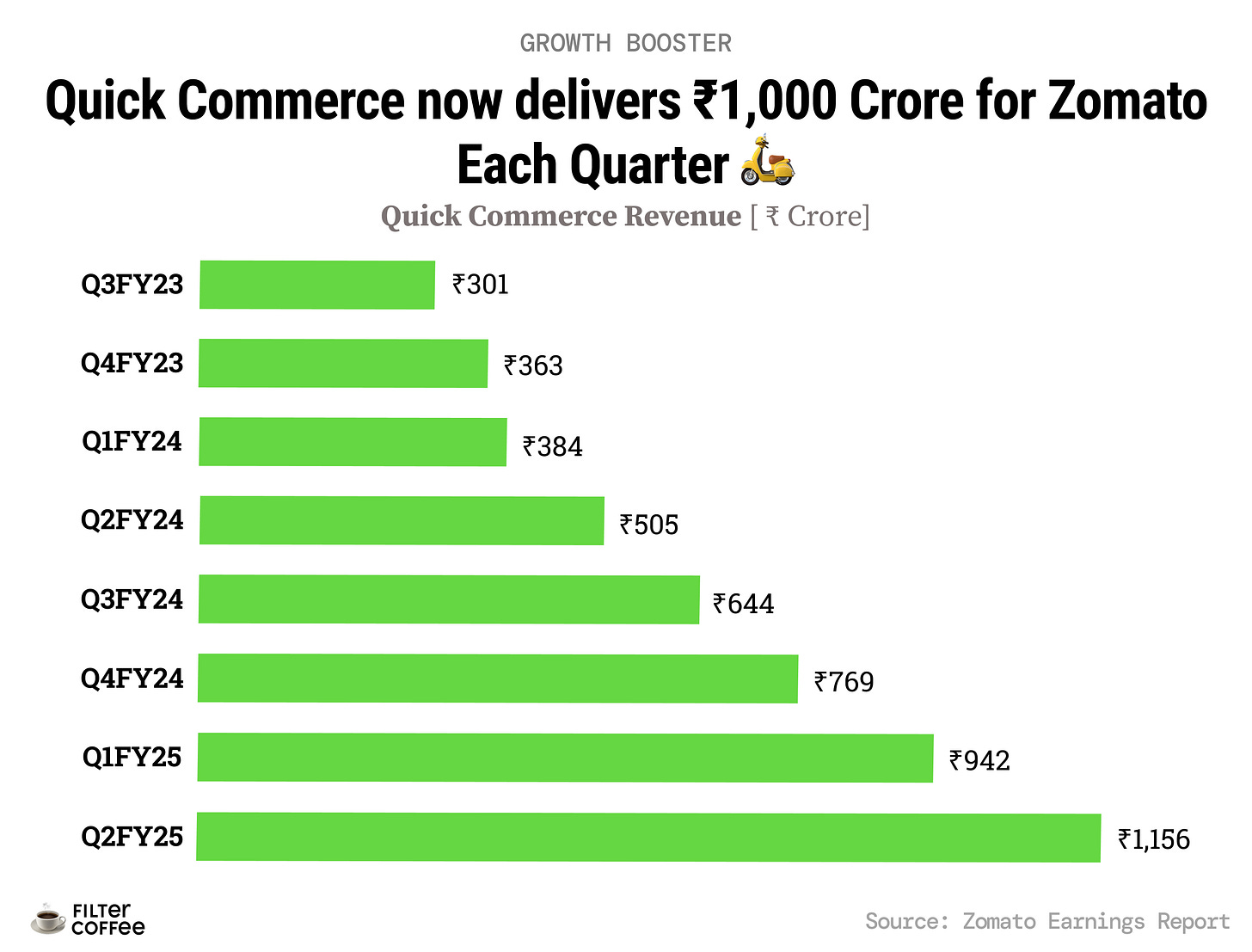

3. Chart of the day 📈

As of last quarter, Quick Commerce is a 1,000 crore+ business a quarter for Zomato, up nearly three times over the past year.

Quick commerce is reshaping how cities consume, with platforms betting big on the segment’s potential, which could redefine industries as it gobbles new product categories.

4. J&J bets big on neuroscience 💊

Johnson & Johnson is acquiring Intra-Cellular Therapies for $14.6 billion. The deal is expected to close later this year.

Context: Intra-Cellular is known for Caplyta, a drug approved for schizophrenia and bipolar depression. J&J plans to expand Caplyta’s reach with FDA approval for major depressive disorder, a condition affecting far more patients.

The numbers: J&J’s neuroscience portfolio recorded $5.34 billion in sales over the first nine months of 2024, flat compared to the same period last year. Caplyta, however, is projected to generate $5 billion in annual sales over the next decade.

The hype: This acquisition boosts J&J’s neuroscience pipeline with promising drugs like ITI-1284, which targets anxiety and Alzheimer’s-related psychosis.

Worth noting: If finalized, this will be the largest biotech acquisition since early 2023, highlighting growing confidence in psychiatric and neurodegenerative treatments as competitors like Bristol Myers Squibb and AbbVie make similar moves.

While we’re on acquisitions,

Back home,

Rashi Peripherals (RPTech), a local distributor of IT hardware, will acquire a 70% stake in Satcom Info Tech for ₹136.2 crore, marking its entry into cybersecurity distribution.

Satcom brings strong financials with ₹170 crore in revenue and ₹2.5 crore in profit for FY24. It also complements RPTech’s extensive network of 50 branches and 63 warehouses.

With 8,400 customers across 680 locations, cybersecurity will bring a high-margin vertical to RPTech’s IT distribution business.

What else are we snackin’ 🍿

⏰ You snooze, you lose: Meta is looking to cut about 5% of its workforce, focusing on the company’s lowest-performing workers.

🚨 Policy shift: Starbucks will limit the use of its cafes and bathrooms to paying customers only, reversing its 2018 “open-door” policy.

💸 RBI reshuffle: India’s central bank appoints Deputy Governor M. Rajeshwar Rao to lead monetary policy and economic research.

🚀 Go for launch: Pixxel launched the first 3 satellites of its Firefly constellation in phase 1 of the launch.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.