Kalyan Jeweller's earnings, Cable free India, and Real estate IPO.

🗓 Morning, folks!

Markets ended sharply lower in the last hour on Thursday, with the Sensex and Nifty falling 0.5%, as tensions between India and Pakistan shook investor sentiment. The rupee also took a hit, posting its biggest single-day drop in over two years.

💡 Spotlight: World Bank President Ajay Banga has made it clear that the Bank won’t be stepping in the India-Pakistan Indus Waters Treaty dispute.

Banga said the treaty isn’t cancelled but is currently ‘in abeyance,’ as per India’s wording. And since the treaty doesn’t allow for suspension or one-sided changes, the only way forward is a mutual agreement or a new treaty altogether.

Let’s hit it!

1 Big Thing: Policybazaar wants to build hospitals 🏥

PB Fintech’s new venture, PB Health, raised $218 million in a seed round.

PB Fintech runs Policybazaar and Paisabazaar, platforms for buying insurance and financial products online.

The why: PB Health plans to set up 4–5 hospitals around Delhi by 2027, with a long-term goal of building a 25–30 hospital network across 10 Indian cities. It’s a full-blown healthcare play, from digital to physical and shows PB Fintech wants to go beyond just selling insurance and actually own a piece of care services itself.

The deets: PB Fintech itself has put in $62 million, giving it a 26% stake in PB Health. The big backer is General Catalyst, the Silicon Valley VC firm known for investing in Indian startups like Zepto, Cred, and Spinny.

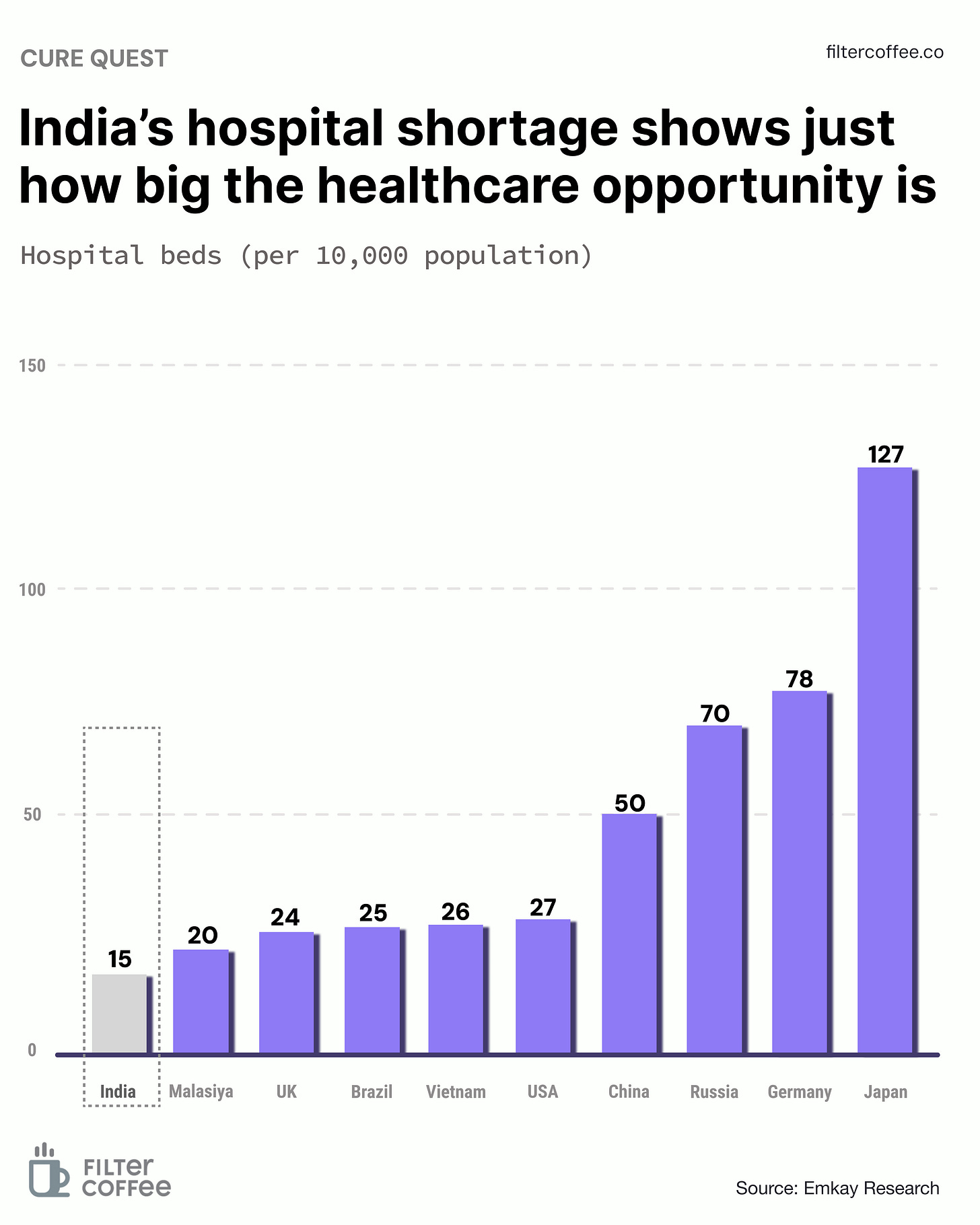

Zoom out: Private money is flowing fast into Indian healthcare. In 2024 alone, the sector attracted 84 deals worth $3.2 billion, following $5 billion in 2023.

While we are on deals,

Routematic, a corporate transport tech company, just raised ₹340 crore in fresh funding to scale its AI-driven office commute solutions.

The company helps businesses manage employee transport using smart routing and real-time tracking, ensuring safe and efficient daily pick-ups and drop-offs.

Zoom out: India’s employee transportation market is projected to hit $13.2 billion by 2030. While EVs make up just 10% of fleets today, that number is expected to rise to 30–35% in the next few years.

2. Kalyan jewellers posted a glittery quarter 💰

Kalyan Jewellers just wrapped up a sparkling March quarter, proving once again that Indians don’t flinch when it comes to gold, even when prices do.

In a quarter marked by wild swings in gold prices, Kalyan delivered a 36.6% jump in revenue to ₹6,181 crore and a 36.5% rise in profit to ₹187.6 crore.

Gold saw sharp ups and downs this year, but Kalyan says it didn’t scare off buyers, especially not the ones shopping for weddings or during Akshaya Tritiya, one of the most auspicious days for buying gold in India.

The company’s strong start to FY25 shows that the emotional pull of gold, especially tied to tradition and life events, often beats price anxiety.

3. India goes cable-free ⚡

India is getting ready to roll out its homegrown wireless charger for EVs.

The deets: the charger has been developed by C-DAC (T) and VNIT Nagpur, and it’s now been handed over to an Indian firm for commercial production.

This new 1.5 kW wireless charger can charge up to 90% of an EV battery in about three hours. Just park, align, and let the tech do the rest.

In simple terms, it runs on a regular household electricity connection. Think of it like wireless phone charging, but scaled up for your ride.

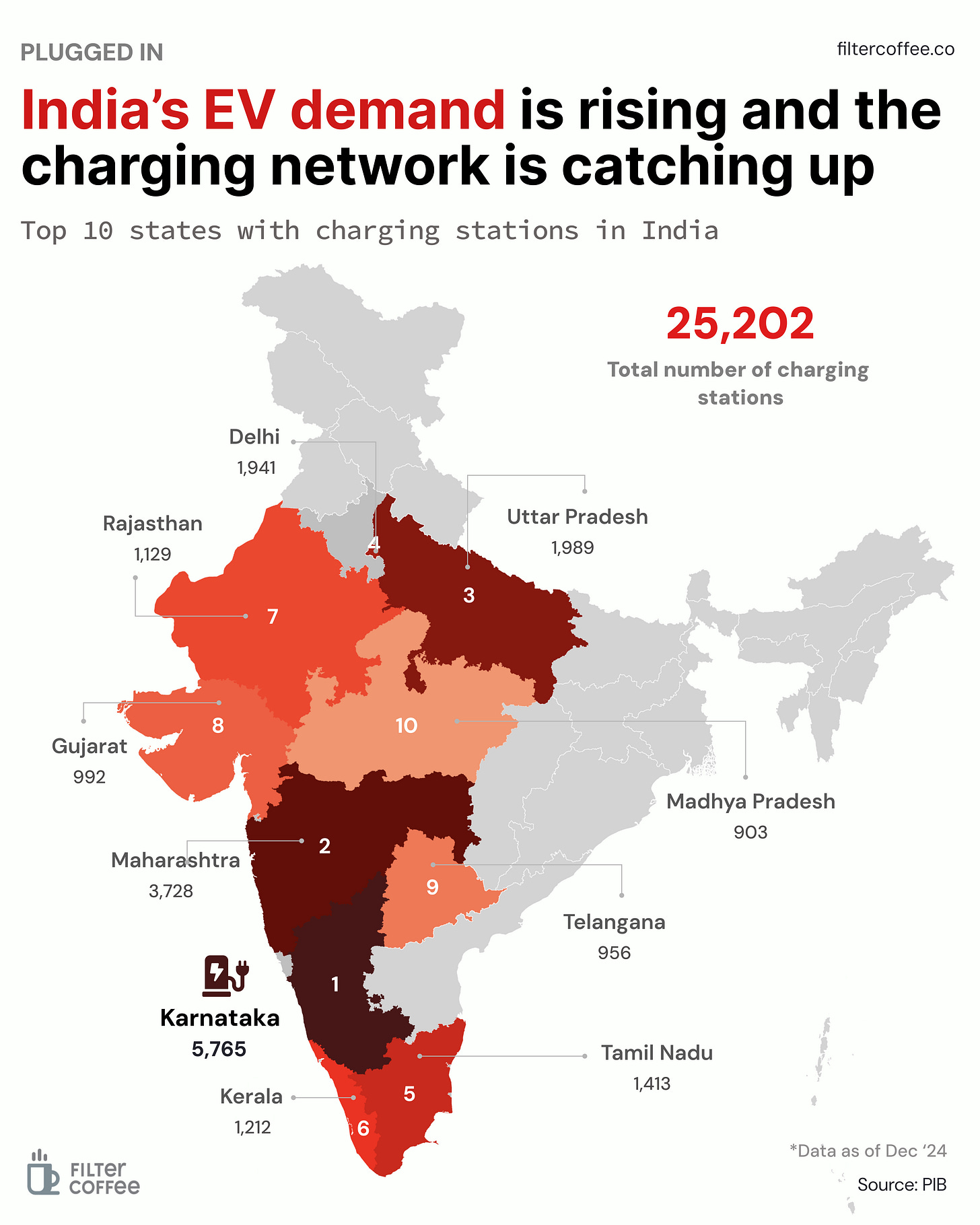

Zoom out: with over 45 lakh EVs already on Indian roads, the government is now pushing hard to upgrade charging tech and expand charging infrastructure. Wireless charging could make EV adoption easier, especially in cities where finding a plug point is still a hassle.

4. PropShare Titania files for an IPO 💰

Property Share Investment Trust (PSIT), India’s first registered small and medium real estate investment trust, has filed draft papers with SEBI. It plans to raise ₹472 crore through an IPO for PropShare Titania, its second SM Reit scheme.

The deets: PSIT is a real estate investment platform that allows investors to own a share of high-quality commercial properties. It focuses on small and medium Reits, offering regular rental income and long-term capital appreciation.

PropShare Titania is a fancy office building in Mumbai with 4.4 lakh sq. ft. of space. It’s already fully rented out to big-name companies like Aditya Birla Capital, Concentrix, and other top global firms.

The IPO will follow the book-building route, in line with Reit regulations. 75% of the net issue will be allocated to institutional investors, while the remaining 25% will go to non-institutional investors.

The why: PSIT plans to use the net proceeds from the IPO to acquire the asset. The scheme expects to pay investors around 9% returns every year for the next few years. It’s designed for people who want steady income from renting out top-quality office buildings.

5. Stocks that kept us interested 🚀

1. Mastek gets a healthy boost in UAE 🏥

Mastek ended nearly 2% higher today, after announcing a new partnership with UAE-based Zulekha Healthcare Group.

The deets: Mastek will roll out a full Oracle-powered hospital management system, software that ties together patient records, billing, and more into a single, seamless platform. It’s all about making hospital operations smoother, faster, and more data-driven.

Why it matters: this deal gives Mastek a strong entry point into the healthcare sector in the Gulf region, where the market is growing with future opportunities.

By delivering end-to-end Oracle Health integration, Mastek positions itself as a tech vendor & as a long-term digital transformation partner for hospitals in the Middle East.

What else are we snackin’ 🍿

✂️ Google cuts: Google laid off around 200 employees from its global business unit, impacting sales and partnership roles.

🛰️ Starlink cleared: Elon Musk’s Starlink has received approval to launch satellite internet in India.

📉 Pakistan panic: Trading was halted at the Pakistan Stock Exchange after their main index - KSE-100 Index crashed 7% on Thursday, triggering a market-wide circuit breaker.

🏭 LG’s India bet: LG Electronics will invest ₹5,000 crore in a new Andhra Pradesh facility, aiming to roll out millions of appliances annually.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.