1. Coal India’s subsidiaries set for IPO move 💸

Coal India Ltd has kicked off the listing process for two of its subsidiaries - Bharat Coking Coal Ltd (BCCL) and Central Mine Planning and Design Institute (CMPDI). Draft papers for their IPOs will be filed with SEBI soon.

BCCL is a key producer of coking coal used in steelmaking while CMPDI is CIL’s technical and consultancy arm. Together, the two firms represent a strategic slice of India’s coal value chain.

Why now: Coal India reported a healthy 12% YoY jump in consolidated Q4 profit at ₹9,604 crore and is looking to build on that momentum.

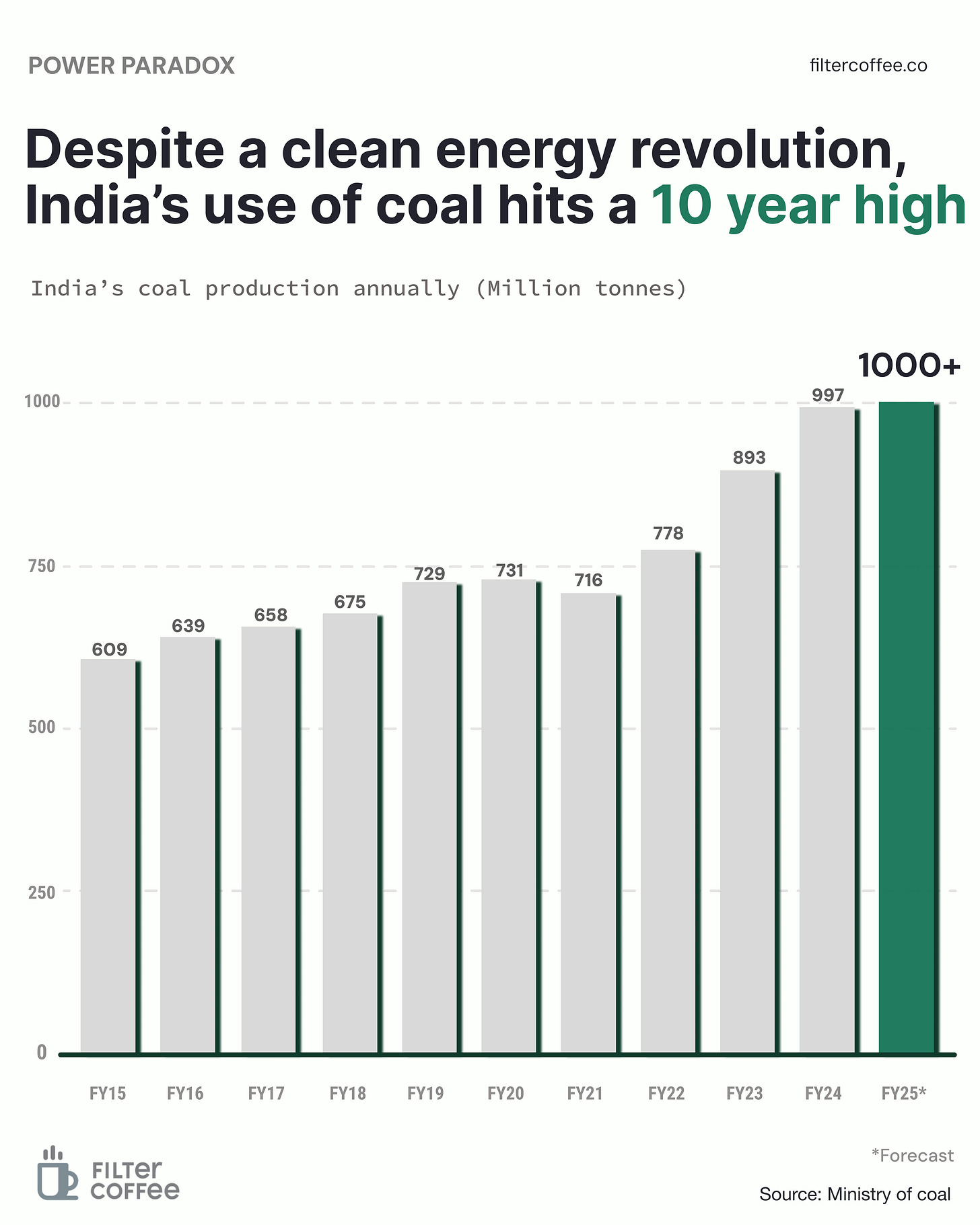

Zoom out: CIL, which controls over 80% of India’s coal production, saw coal output hit 781 MT in FY25 slightly below target. But it’s eyeing 875 MT for FY26, with offtake set at 900 MT.

2. Loan Giant ARCIL Plans ₹1,500 Cr IPO 💰

India’s oldest bad loan buyer, Asset Reconstruction Company (India) Ltd (ARCIL), is preparing to go public. The company has started work on its draft red herring prospectus for an IPO that could raise anywhere between ₹1,000 and ₹1,500 crore.

ARCIL specialises in acquiring non-performing assets basically, bad loans from Indian banks and financial institutions. It helps clean up lenders’ books by taking over stressed assets and trying to recover value from them.

It is currently backed by US-based Avenue Capital Group and is also sponsored by SBI.

3. Sri Lotus gets green light for ₹792 Cr IPO 🏗️

Sri Lotus Developers and Realty, the Mumbai-based luxury real estate player has secured SEBI approval for its ₹792 crore IPO.

Sri Lotus operates across Greenfield, Redevelopment, and Joint Development models. It’s targeting the ultra-luxury segment, tapping into Mumbai’s growing appetite for high-end homes.

The deets: the IPO is a pure fresh issue, no offer for sale. Proceeds will be used to fund ongoing premium redevelopment projects in Mumbai’s western suburbs.