☀️ Morning folks,

Hope the weekend wasn’t too short.

📈 Mr. Market kicked off 2025 on a positive note. The Nifty and Sensex both advanced last week, up over 1.5% each. The S&P and Nasdaq also finished in the green.

Quick spotlight: 2024 was a record year for the National Stock Exchange, with 268 IPOs raising ₹1.67 lakh crore, leading Asia in IPOs in public market listings.

The trend is expected to continue in 2025.

Lets hit it!

1 Big Thing: Unilever's $350M skin in the game 💅

2025 is off to a great start with a major FMCG acquisition brewing.

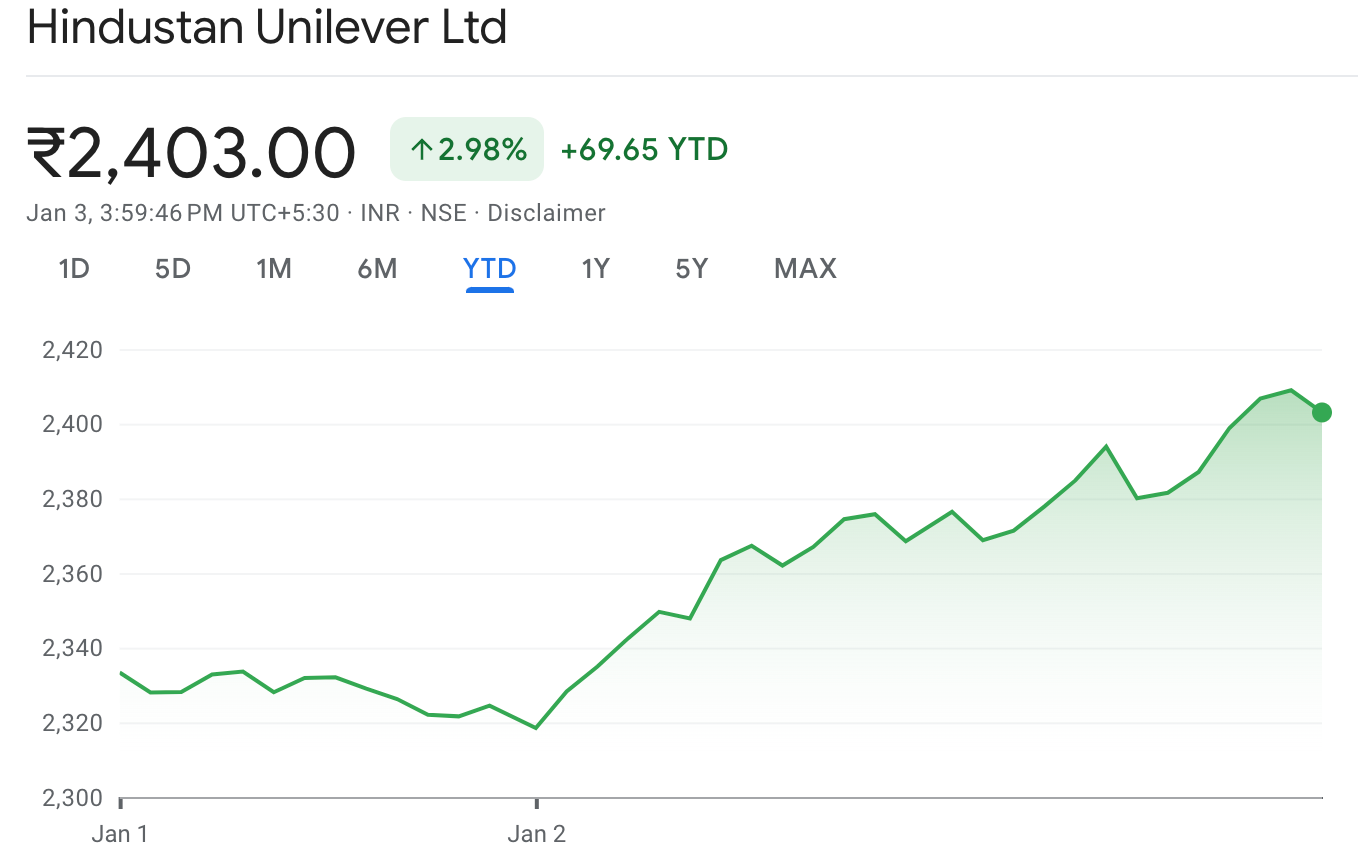

Hindustan Unilever is set to acquire Minimalist, a fast-growing skincare brand, for up to $350 million.

Here’s the deal: Minimalist offers a range of skincare products, from sunscreens to hair-repair serums, and was founded less than 5 years ago.

Business is strong. Minimalist saw impressive growth of 89% YoY in sales for FY24, with revenues over $40 million. The company is already profitable.

Why it matters: this acquisition follows previous buys—Oziva and Wellbeing Nutrition—and would further diversify their portfolio away from their usual shampoos, teas and packaged foods.

Worth noting: HUL’s venture arm was already an investor in Minimalist, so they had a front row seat into the ramp up.

Big picture: India’s beauty market is set to hit $34 billion by 2028, up from $21 billion right now. Growth is coming from a shift towards premium, high quality products.

Stock has responded positively to the news.

2. NTPC’s new clean energy bet 🌍

2025 might also be the year of clean energy, perhaps the entire decade.

NTPC Renewable Energy, a subsidiary of NTPC Green Energy and one of India’s leading green energy companies, has secured a 1000 MW solar power project in Uttar Pradesh.

The deets: this project is part of a 2,000 MW solar initiative under India’s tariff-based competitive bidding scheme, which promotes transparency and competitive pricing.

Why it matters: as India pushes for more clean energy, NTPC’s strategic wins in solar power align with the country’s renewable energy goals.

Zoom out: the government is doubling down aggressively on clean energy, with a goal to take renewable capacity to 500 GW by 2030.

3. AI got all the money 🤖

Generative AI funding hit a record $56 billion in 2024, a 192% jump from 2023’s $29.1 billion.

The deets: Q4 alone accounted for $31.1 billion, driven by Databricks’ $10 billion Series J, which was deemed the largest venture round ever. Other major deals included Anthropic’s $4 billion Amazon deal.

AI related M&A was also popular, with deals totalling $951 million. Google and Microsoft led the pack in such deals.

Worth noting: Google is said to have spent $2.7 billion to acquire most of Character AI’s team and license its technology, while Microsoft dropped $620 million to license Inflection’s AI models and hire CEO Mustafa Suleyman.

U.S. startups dominated, but European players like Moonshot AI with $1 billion and Mistral with $640 million made waves.

4. $80 billion for data centers 💻

Microsoft is set to spend $80 billion to build data centers focused on AI workloads in 2025.

Why care: with AI going mainstream, this investment is a clear signal of Microsoft’s commitment to leading the charge in AI infrastructure.

Over half of the $80 billion will go to the U.S., with the rest spread across global operations.

The details: the data centers will support everything from training models to deploying cloud-based AI apps.

One of the biggest challenges that tech giants are currently working to solve is securing the energy needed to power these data centers.

Zoom out: data centers are set to experience significant growth, with the global market expected to reach $418 billion by 2030, growing at a compound annual growth rate (CAGR) of 9.6% from 2024 to 2030.

Pop quiz of the week ⚡

This company is a leading manufacturer of steam turbine generators, specializing in power generation and combined heat & power solutions.

They’ve delivered over 6,000 turbines across 80 countries, serving industries like oil & gas, chemicals, and renewables.

They have a market cap of over ₹24,000 Cr.

Which company is this?

Answer to last week's quiz: Uno Minda.

What else are we snackin’ 🍿

🤝 Tim donates: Apple CEO Tim Apple will personally donate $1 million to President-elect Trump’s inaugural committee.

📉 Running low: India’s forex reserves fell by $4.11 billion to $640.28 billion during the week that ended on 27 December.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.