Healthcare bet, New AI model in town, and A defense win.

☀️ Good Morning, its Tuesday.

Monday brought a violent bloodbath in U.S. stocks not seen for a few years… The Nasdaq for example crashed 4% at a point, worst since Sep 2022.

Trump’s playbook of wrecking the economy and pushing the Fed to lower rates might just be working.

Back in India, the Nifty and Sensex, are starting to stabilize a bit. Worth noting, for the first time in years, the Nifty is now cheaper on an earnings basis than the Dow

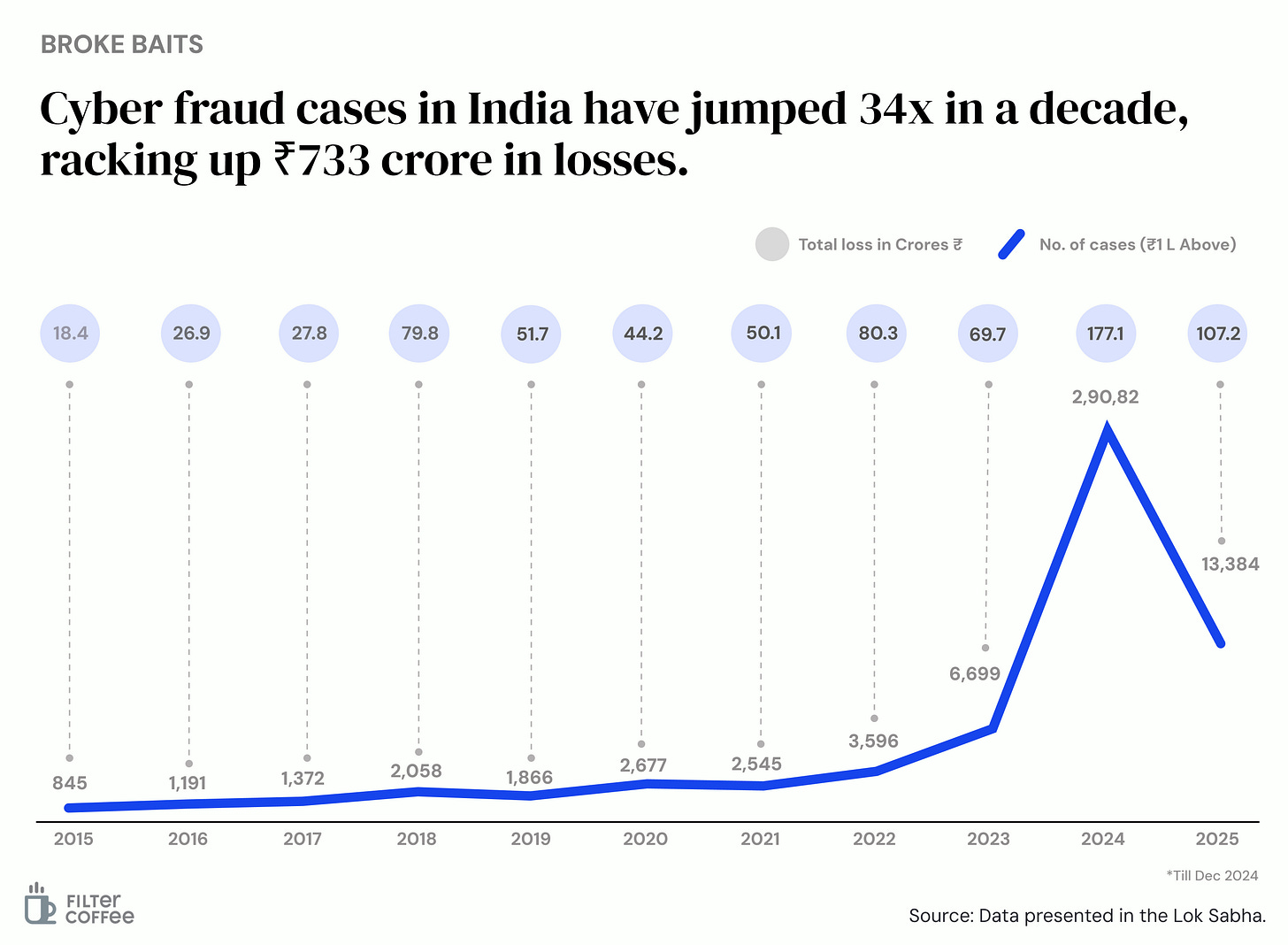

💡 Spotlight: X was hit with a cyberattack yesterday, putting Elon’s duct-tape engineering setup to real test. On that note, India lost nearly ₹107 crores to cyber fraud in the first three quarters of FY25, with over 13,300 cases reported.

Let’s hit it!

1 Big Thing: Sun Pharma makes a cancer bet 💊

Mumbai-based Sun Pharma, one of India’a largest Pharma companies, acquired a Nasdaq-listed company, called Checkpoint Therapeutics for $355 million.

Context: Checkpoint specializes in cancer immunotherapy—a treatment that uses the patient's own immune system to fight cancer. The company had recently secured FDA-approval for UNLOXCYT, a breakthrough drug for advanced skin cancer.

There is roughly 1.8 million skin cancer cases annually in the U.S., and 15,000 deaths each year, a massive opportunity for Sun Pharma to plug the gap.

Sun’s strategic bets: Sun Pharma has been quitely building its dermatology portfolio. In 2023, Sun Pharma had acquired Concert Pharma for $576 million.

Big picture: Sun could potentially also bring the cancer immunotherapy product to India. Cancer immunotherapy market is expected to more than double in India by 2030, to over $4.4 billion. Today, less than 3% of cancer patients in India currently have access to immunotherapy due to high costs.

2.China models keep pressure on 🧠

DeepSeek is old news. Make way for Manus—a state-of-the-art AI agent launched by Chinese AI scientist Yichao “Peak” Ji, sending shockwaves through the global AI stage.

Jack Dorsey calls it “excellent”. Hugging Face and other AI communities are blown away.

The Agent can autonomously handle tasks such as finding homes to purchase, sorting resumes, or conducting investment research and analysis.

In all, it marks another significant win for China’s nascent AI ecosystem, which continues to operate frugally without the bells and whistles of limitless AI infrastructure resources as the Americans.

For now, Manus is in invitation-only private testing.

And while we’re on AI,

Taiwanese electronics giant, Foxconn, launched its own AI model yesterday—called “FoxBrain,” which will be used to improve manufacturing and supply chain management.

The model, uses Meta’ Llama model at its core, and was further trained using 120 of Nvidia’s powerful H100 AI chips in just four weeks to make it more specific.

4. NTPC bets on Chhattisgarh ⚡

The stock market may have fallen out of love with clean energy. But not power companies.

NTPC, India’s largest power company, will invest nearly ₹96,000 crores across nuclear, pumped hydro, and renewable energy projects in the state of Chhattisgarh.

The deets: the biggest chunk—₹80,000 crore—will go into setting up a 4,200 MW nuclear power plant. Another piece, about ₹6,000 crores will go towards a 1,200 MW pumped hydro storage project in partnership with Chhattisgarh’s state power company.

Big picture: on a per-capita basis, Indian households consume nearly 46% more electricity today than they did a decade ago. These investments are focused on ensuring India’s rapidly expanding consumer base has enough clean power to keep growing.

5. Major stock market moves to keep up with 🚀

- Tesla crashed 15% in yesterday’s sell off, and has now lost 40% of its value year to date, as the EV market competition continues to rise. In Europe, China—two key markets, the company has been rapidly losing share. Add to that Musk’s shenanigans with Trump, which make his brand an easy target.

- More winners? Look at China tech. Alibaba is up 50% so far this year, as the AI wave re-energizes the local market in China. But context matters—China’s tech sector was in free fall for the past five years. Alibaba, despite its recent rally, is still down 30% over that period, underperforming even the Nifty 50, which has more than doubled.

- A lesser-known Indian stock, Bodal Chemicals, surged 15% yesterday after the government imposed anti-dumping duties on key chemical imports used in water treatment and sanitization. As India’s sole producer of TCCA, Bodal stands to benefit significantly, with annual revenue projected to increase by ₹10 crore from FY26.

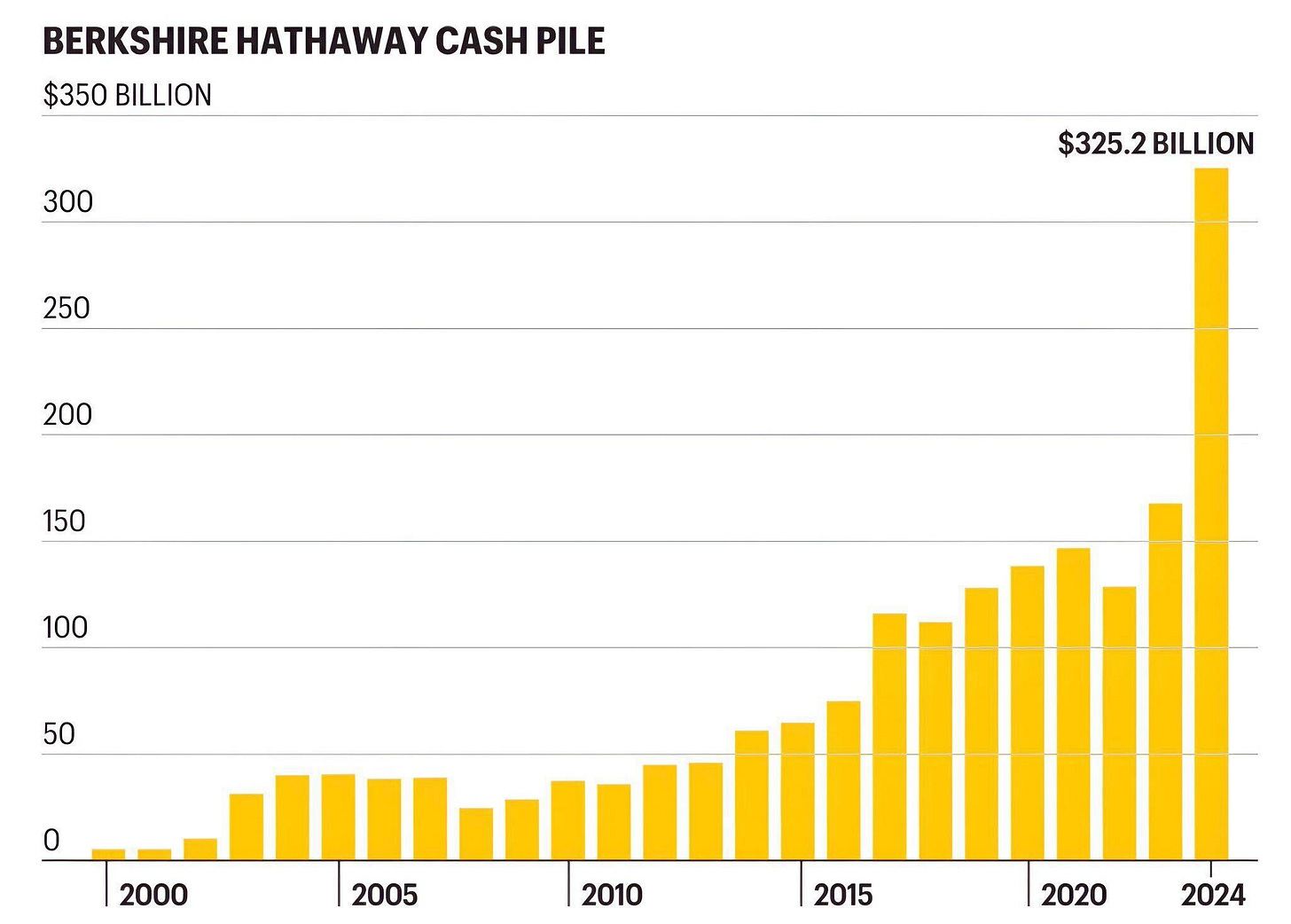

As the rest of the market wets the bed, Warren Buffett’s Berkshire Hathaway is quietly riding it out. Buffett had been steadily moving to cash, now sitting on nearly $350 billion in U.S. Treasury bills. So far this year, Berkshire is up nearly 10%.

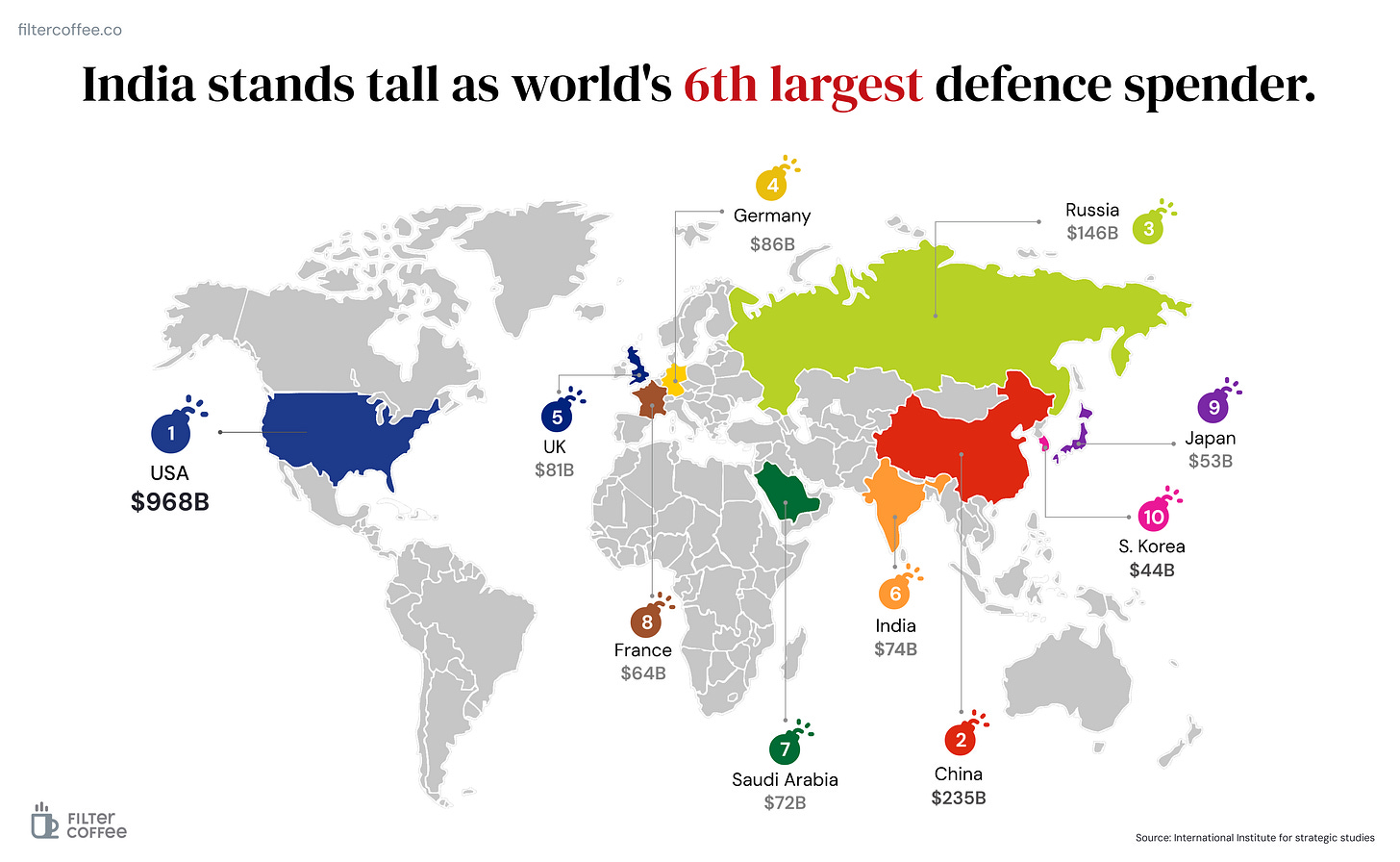

6. Story in Data — Defense budgets are booming 💥

India’s defense spending is on the rise as global military budgets swell.

With heightened geopolitical tensions and a push for self-reliance, India is ramping up investments in indigenous defense manufacturing.

Europe is also increasing its defense budgets, preparing for uncertainties as conflicts escalate.

Global trends indicate a renewed arms race, with countries doubling down on military readiness. For India, the challenge is clear—modernize fast while keeping the economy in check.

What else are we snackin’ 🍿

🇨🇦 Reshuffle: Mark Carney is replacing Justin Trudeau as Canada’s next PM, winning the leadership race with 85.9% votes.

🤑 GST tonic: India is looking to cut GST rates further as a panel reviews tax slabs in line with economic growth, says FM Sitharaman.

🃏 Nazara folds: Nazara Tech is selling Classic Rummy to PokerBaazi’s parent, Moonshine, for ₹104.33 crore.

🍽️ For eternity: Zomato’s rebrands itself as Eternal Ltd. Shareholders approve name change, marking new strategic shift.

📈 China chills: Consumer inflation turned negative in February for the first time in 13 months as food, drink, and tobacco prices fell.

📦Out of stock: Amazon is shutting down its refurbished platform, Renewed, citing growing challenges—leaving Flipkart’s Yaantra and Cashify to dominate the space.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.