Crypto down, Paytm international, and A Gold surge.

🗓 Morning, folks!

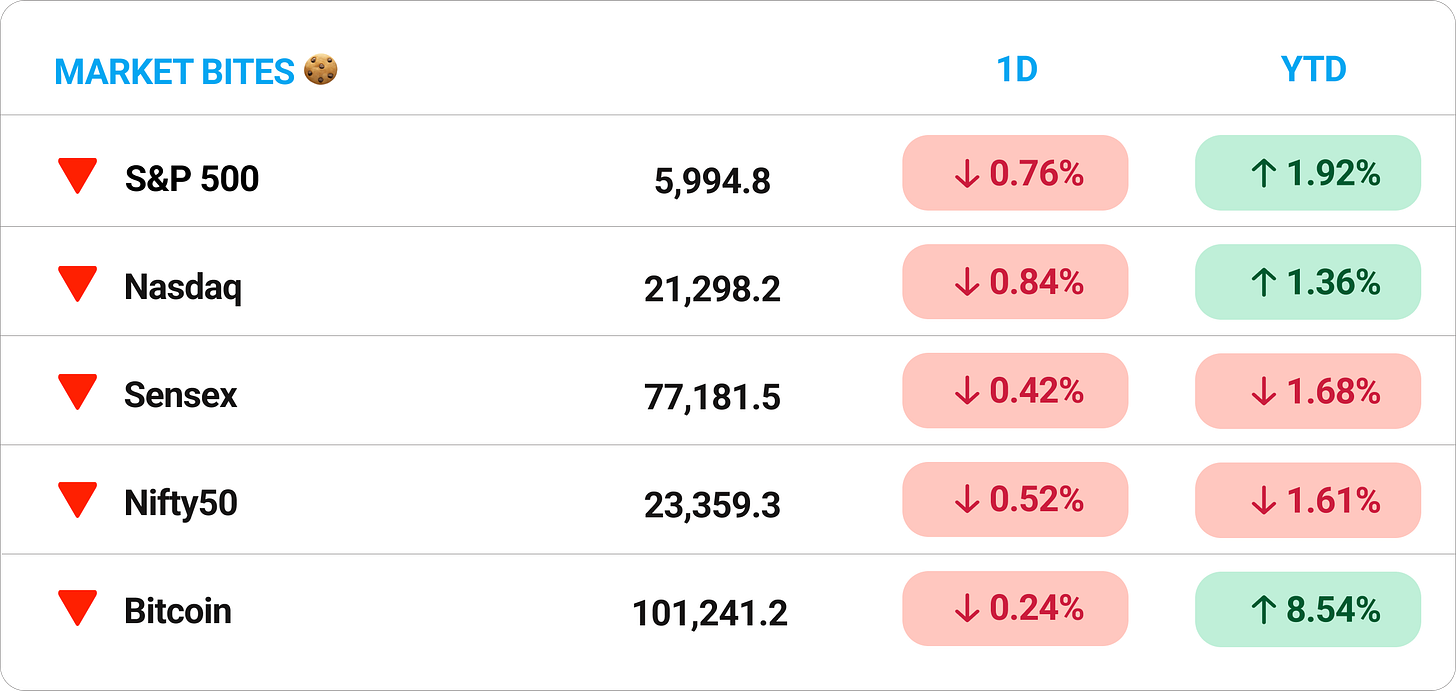

Budget optimism was overpowered by Trump-tariffs. Markets stumbled to start the week, with Sensex down 0.4% and Nifty slipping 0.5%.

Both indexes are now trading nearly 10% below their September highs.

💡 Spotlight: the Budget’s focus on nuclear power deserves kudos. India has set an ambitious target of 100GW in power production capacity, using Nuclear Energy by 2047. ₹20,000 crores have been outlined.

1 Big Thing: OpenAI throws a punch 🤖

The Chinese had their moment of fame, but OpenAI has clapped back with o3-mini, its most advanced mini-reasoning model yet—following in the footsteps of o1-mini.

Hard to keep up with all these Os!

The juice: the newest o3-mini is designed to match performance in math, coding, and science of Open AI’s best models, while responding 24% faster and with better accuracy. With reasoning, the model also shows how it worked out an answer instead of just providing a response.

The mega theme: instead of training bigger models on BIGGGGERR hardware, the entire industry is right now focusing on making existing models more efficient to respond to your queries. Which, in other words, is called AI inference.

With low latency and quick speed, such models are a better fit for real-time AI interactions. But it also means longer response times for higher intelligence modes, which makes the model more expensive to operate.

The big move: this is the first time OpenAI’s reasoning models are available to free ChatGPT users.

2. Deals that made noise 💰

Paytm is acquiring a 25% stake in Seven Technology LLC, the parent company of Brazilian embedded finance startup Dinie, for $1 million.

The deets: Dinie provides embedded credit solutions to merchants in Brazil, with a focus on small businesses.

While Paytm’s exact move isn’t clear, the Brazil and Latin America fintech market is an absolute beast of an opportunity. The population, much like India and in the absence of friendly banking solutions, overwhelmingly loves digital wallets and mobile finance solutions.

- Brazil’s depth can be judged by looking at Nubank, a fintech banking disruptor, founded in 2013, currently listed on the NYSE at a $62 billion market cap, with nearly $6 billion in annual revenue.

Anyway, this marks Paytm first investment in Latin America. Stock went up 3.7% on the news.

While we are on acquisitions,

TVS Holdings acquired 80% stake in Home Credit India for ₹554 crore.

The deets: Home Credit India focuses on providing consumer durable loans, personal loans, and financing for low-cost smartphones, primarily catering to New-to-Credit (NTC) customers.

It operates across 625 cities, serving over 16 million customers.

The deal aligns with TVS Holdings' financial services expansion, with the group aiming to grow its lending book to ₹50,000 crore in the next three years.

TVS Holdings had previously exited its real estate business, choosing instead to double down on financial services.

3. Ola takes back the EV crown ⚡

Things haven’t exactly been rosy for Ola in 2024, with layoffs, EVs catching fire, mounting shareholder pressure, and top execs including the CTO and CMO walking out.

But momentum continues to hold tight, and now Ola is back on top in January, capturing a 25.8% market share for the month with 24,330 units sold.

This rebound comes after Ola had slipped behind TVS and Bajaj in December, which suggests these wars will be prolonged. For December, TVS sold 23,788 units, while Bajaj came third with a 21.8% market share and 21,294 units sold.

Zoom out: earlier last month, Ola had disclosed that the company had opened storefronts across 4,000 total locations across India, at breakneck speeds.

Big theme: India’s EV penetration remains under 7%, with a long healthy road ahead for growth.

But competition is fierce, margins are tight, and market expectations lofty. Not a theme for the faint hearted.

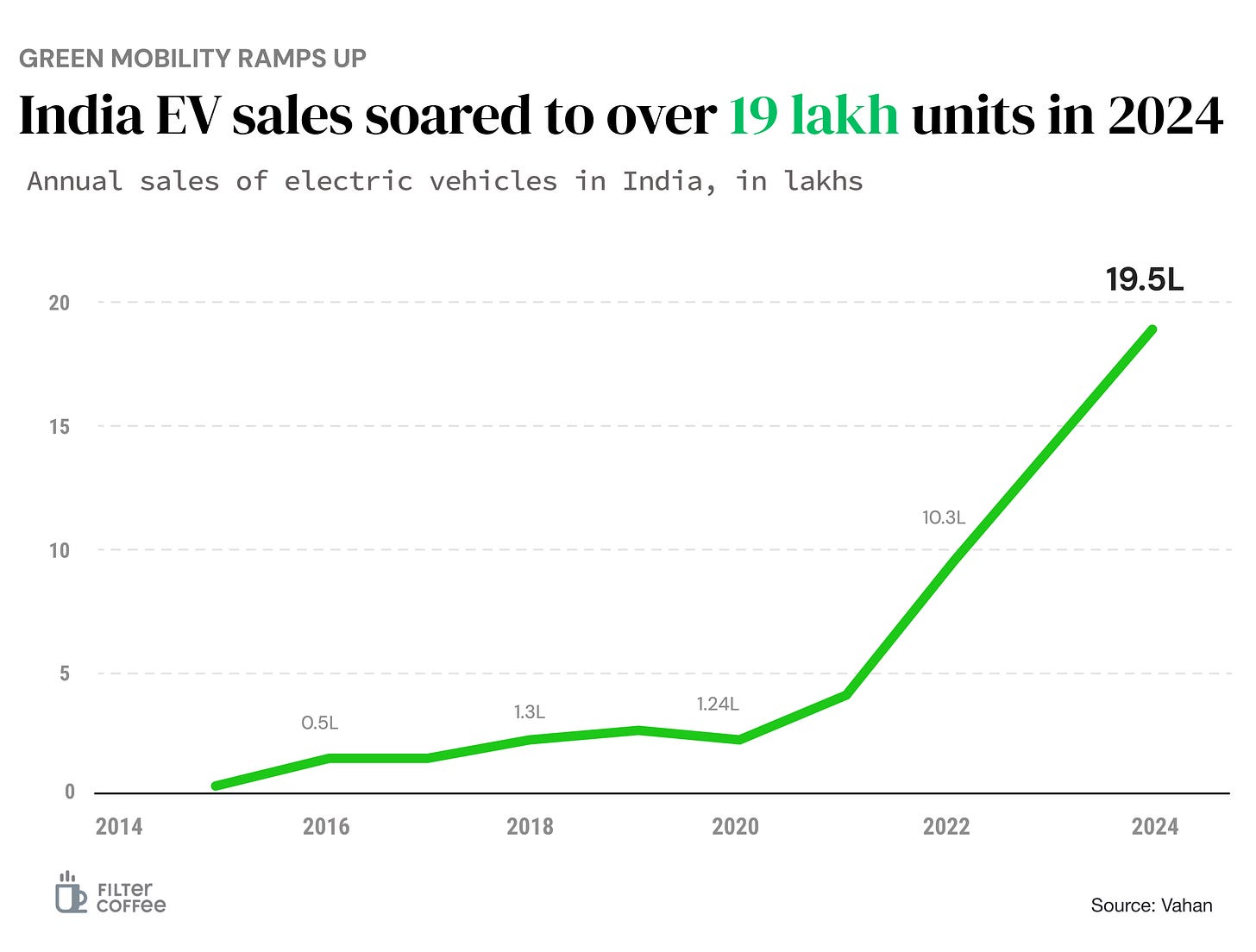

4. Chart of the day — India’s EV ramp up 📈

Nearly 19.5 lakh EVs were sold in India in 2024, nearly doubling from the year before.

Policy plays a role, but the surge was driven by rising fuel costs, especially for commuters, along with increasing market optionality and some discounting.

The next challenge? Scaling infrastructure to keep pace and growing into the total addressable market.

What else are we snackin’ 🍿

🏎️ Louis go vroom: Louis Vuitton has become an Official Partner of Formula 1 in a wide-ranging 10-year deal.

🏍️ Leadership move: TVS Motors has appointed Gaurav Gupta as President – India for its two-wheeler business, overseeing both EV and ICE divisions.

💰 Gold surges: Gold prices hit a record ₹85,300 per 10g, driven by strong demand, rupee depreciation, and global trends.

📉 Rate cuts: RBI likely to cut rates this Friday for the first time in 5 years, as focus shifts to boosting a slowing economy.

👎 BTC down: over $2 billion in value was liquidated from cryptocurrency markets over the past 24 hours

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.