Nuclear ambitions, Stock moves and AI’s Big Leap.

🗓 Morning, folks!

Markets were back in rally mode, with Sensex surging 1.8% and Nifty jumping 1.6%. Investors seem to be shaking off the recent market jitters, at least for now.

💡 Spotlight: in a very tit-for-tat move, China hit back just moments after Trump’s 10% tariff on Chinese goods, escalating the trade war.

Beijing announced export controls on tungsten-related materials, slapped new tariffs on U.S. coal, LNG, oil, and agricultural equipment, and added a few companies to its unreliable entity list.

Let’s get into it.

1 Big Thing: India joins the AI race 🧠

Ola’s Bhavish Aggarwal is doubling down on Krutrim, Ola’s AI venture, by investing ₹2,000 crore into the business, with plans to scale up to ₹10,000 crore by next year.

- So far it is unclear if that capital is his own or comes from Ola’s coffers.

Nonetheless, it is one of the boldest moves coming from India, as the U.S. and China both scale investments into frontier models.

The details: Krutrim will launch a frontier AI lab, roll out Krutrim 2, and will work on expanding into vision, speech, and text translation models, all while keeping the technology designed for local Indian cultural context and languages.

Additionally, Krutrim will work with Nvidia to offer the GB200 chips in India, starting March 2025 — in of the firsts to bring the state of the art processor to market locally. The GPUs will be available through Krutrim cloud.

FYI, Krutrim had previously raised $50 million at a $1 billion valuation, making it India’s first AI unicorn in 2024.

Too little, too late? Open AI had a multi-year head start, and tens of billions invested, now scaling to hundreds. The Chinese are leading in their own way, innovating with limited resources amidst tight export restrictions of chips by the Americans.

Frankly speaking, ₹2,000 crores (~$230 million) may not be enough to catch speed. But, it is $230 mill more than we had 2 days ago chasing this opportunity, and could be critical in jump starting innovation on already available open-source technology. We'll take it.

Mr. Market liked the news—Ola’s stock popped 2.3%.

2. A patchy finish for Asian Paints 🎨

Back on Dalal Street, Asian Paints caught up with investors to discuss its December quarter numbers, which overall left investors wishing for more.

By the numbers:

- Asian Paints’ revenue came in at ₹8,549 crore, down 6% YoY, missing expectations by a good ₹300 crores

- Net profit dropped 23.5% YoY to ₹1,128 crore, again below estimates.

- The decorative business grew 1.6% YoY, not cool

Pulse check: paint businesses often serve as a barometer for the economy, as consumer confidence and disposable income typically drive renovations and festive spending. Their weakness is not an encouraging sign, and management concurred.

Big picture: with nearly 55%+ market share in India, Asian Paints is a dominant force in the industry, but has steadily been losing share. Investors haven’t been very happy with the stock, although the earnings did cause a 3% pop.

While we’re on earnings…

Tata Power’s results were a mixed bag, reflecting steady growth but making investors generally nervous, given the massive run up over the past few years.

Revenue rose 5% YoY to ₹15,391 crore, falling short of estimates, while net profit climbed 10.3% to ₹1,187 crore.

Amidst a lot of the positive commentary, the company’s management cited enthusiasm to get into the Small Modular Nuclear Reactor business, as the government slowly opens the market.

3. Big daily movers 🚀

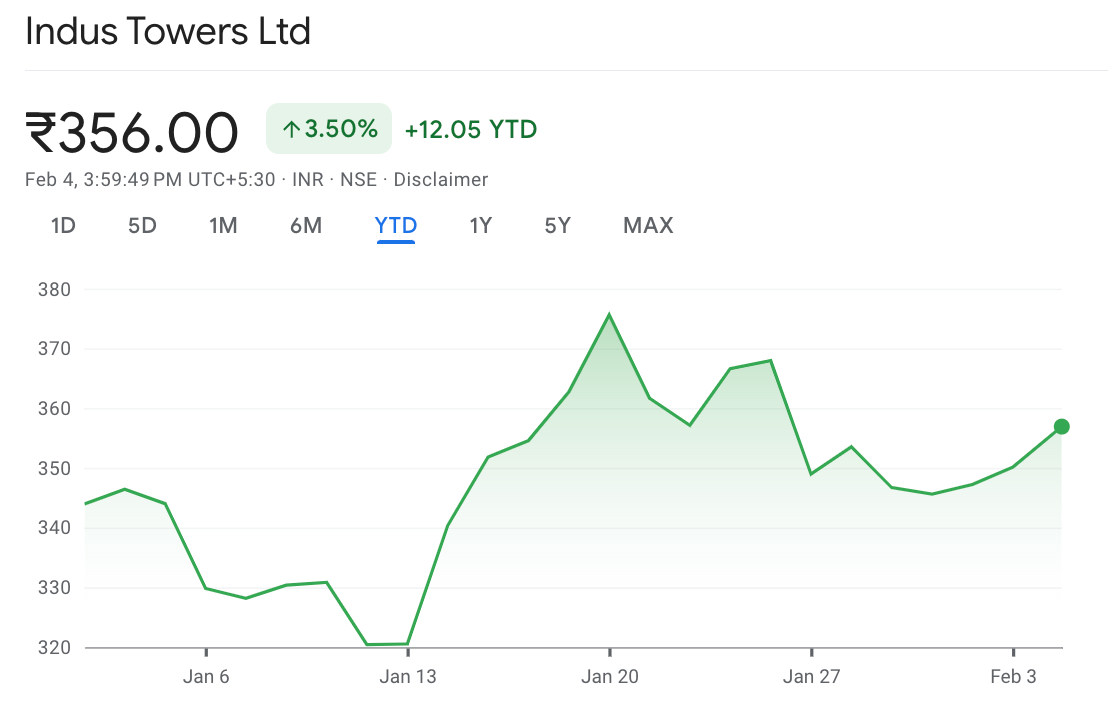

Indus Towers jumped over 2% after the company acquired a 26% stake in Amplus Tungabhadra Private Limited, a special purpose vehicle (SPV), for ₹27 crore.

FYI, Indus Towers is a telecom infrastructure player that builds and operates mobile towers for major network providers.

Why it matters: the deal helps Indus Towers secure 50 MW of renewable energy to power its operations, aligning with regulatory requirements and its Net Zero goals.

The company, part of the BSE 200 index, has a market capitalization of over ₹93,000 crore.

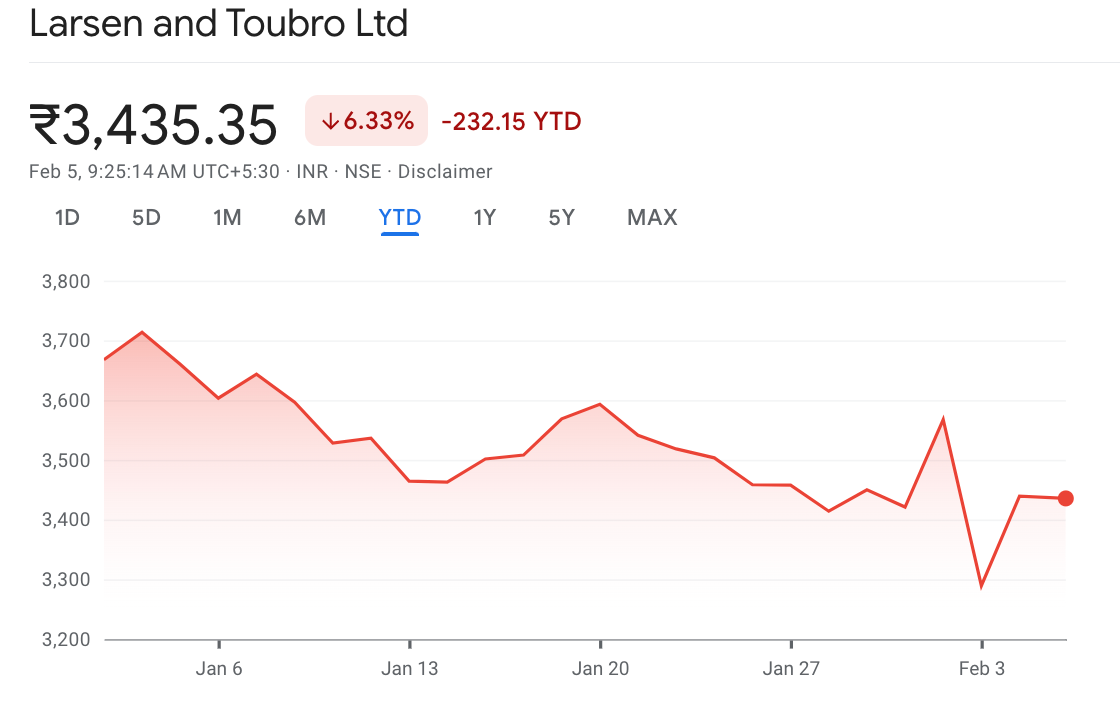

Larsen & Toubro (L&T) rose 4.3% after announcing a major Middle East contract.

L&T is a $27 billion multinational engaged in EPC projects, hi-tech manufacturing, and industrial services across multiple geographies.

Context: the surge followed the announcement that L&T’s Minerals & Metals division will be setting up a Pellet and Direct Reduction of Iron (DRI) plant for a leading steel producer in the Middle East and North Africa region.

The order is part of a global decarbonization push.

Net profit jumped 13.9% YoY to ₹3,359 crore in Q3FY25, while revenue climbed 17.3% YoY to ₹64,668 crore, boosted by a strong order book and execution momentum.

4. Modern world, modern tools 🤖

Presentations.ai, an AI-powered platform for generating presentation decks, raised $3 million in a seed round led by Accel.

The round comes as the startup emerges from beta, having onboarded over 5 million users since 2023.

Presentations.ai is basically a ChatGPT for presentations, helping businesses draft, refine, and design decks instantly using AI.

The funding will fuel product development and expansion, but taking on battle tested PowerPoint or Google Slides is not going to be easy.

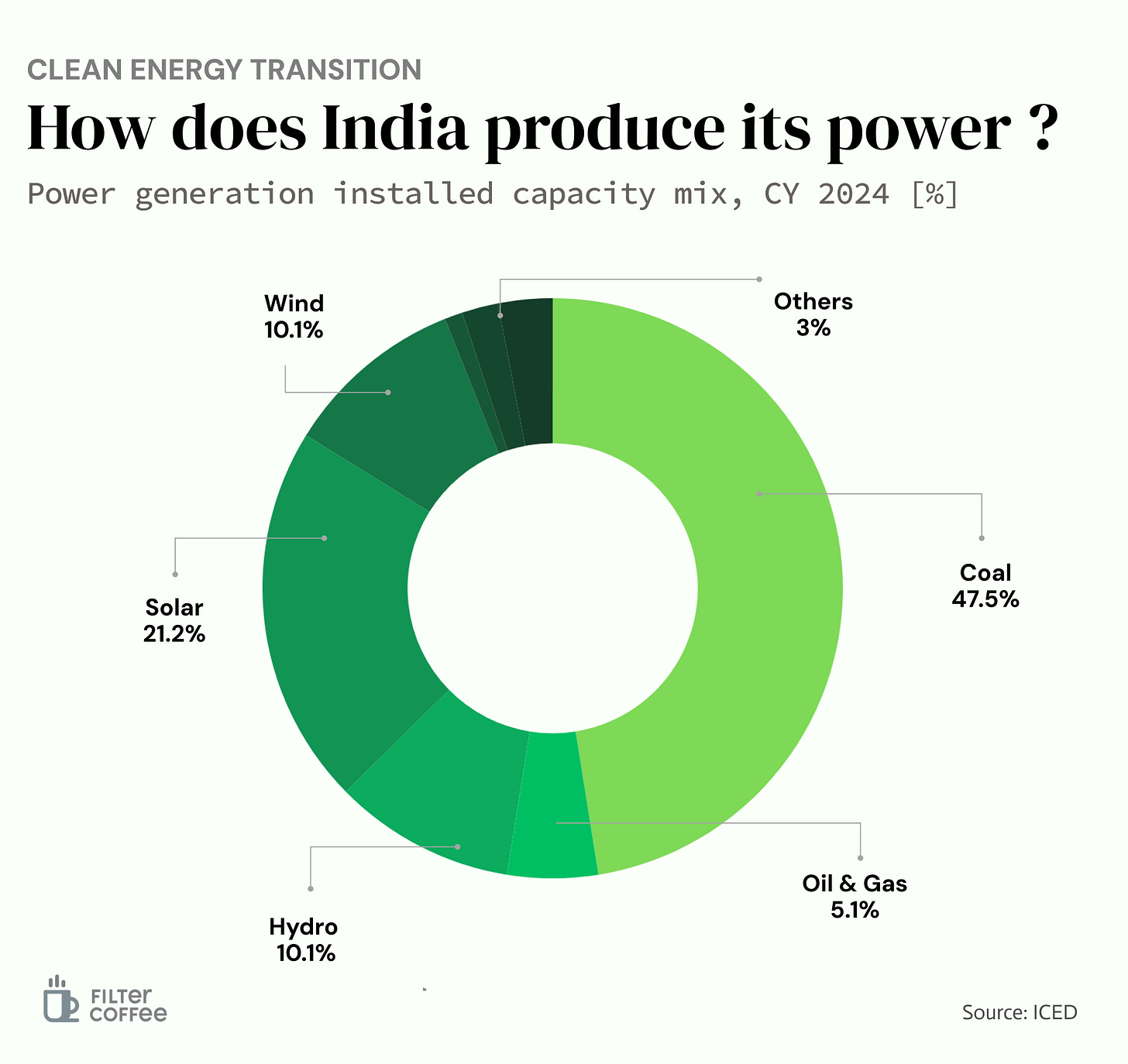

5. Chart of the day - Renewables growing into the mix 📈

India’s energy mix is still heavily reliant on coal, which makes up 47.5% of installed capacity as of 2024. But that is down significantly from nearly 80% in 2010.

Renewables, however, are catching up, solar leads the charge with 21.2%, while wind and hydro contribute over 10% each. This shift signals a growing push toward cleaner energy sources.

The challenge? Reducing dependency on coal while scaling renewable infrastructure while meeting the power demands of a hungry growing nation.

What else are we snackin’ 🍿

🤖 Layoffs: Salesforce is cutting 1,000+ jobs while hiring for AI-focused roles as it bets big on artificial intelligence.

⛽ Oil drops: oil prices fell as Trump pushed back tariffs on Mexico and Canada, easing market fears.

🎶 Spotify: after 17 years, Spotify closed its first full year of profitability, adding 35M new users in Q4.

🔓 Aadhaar access: India is easing Aadhaar authentication rules, allowing businesses to verify users, sparking privacy concerns over biometric data use.

🚨 Trade tensions: Modi will meet Trump at the White House next week to “further deepen their partnership.” This meeting comes amid recent trade tensions.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.