Pharma acquisitions, Mouri Tech's IPO, Tata Motors split up.

Morning folks!

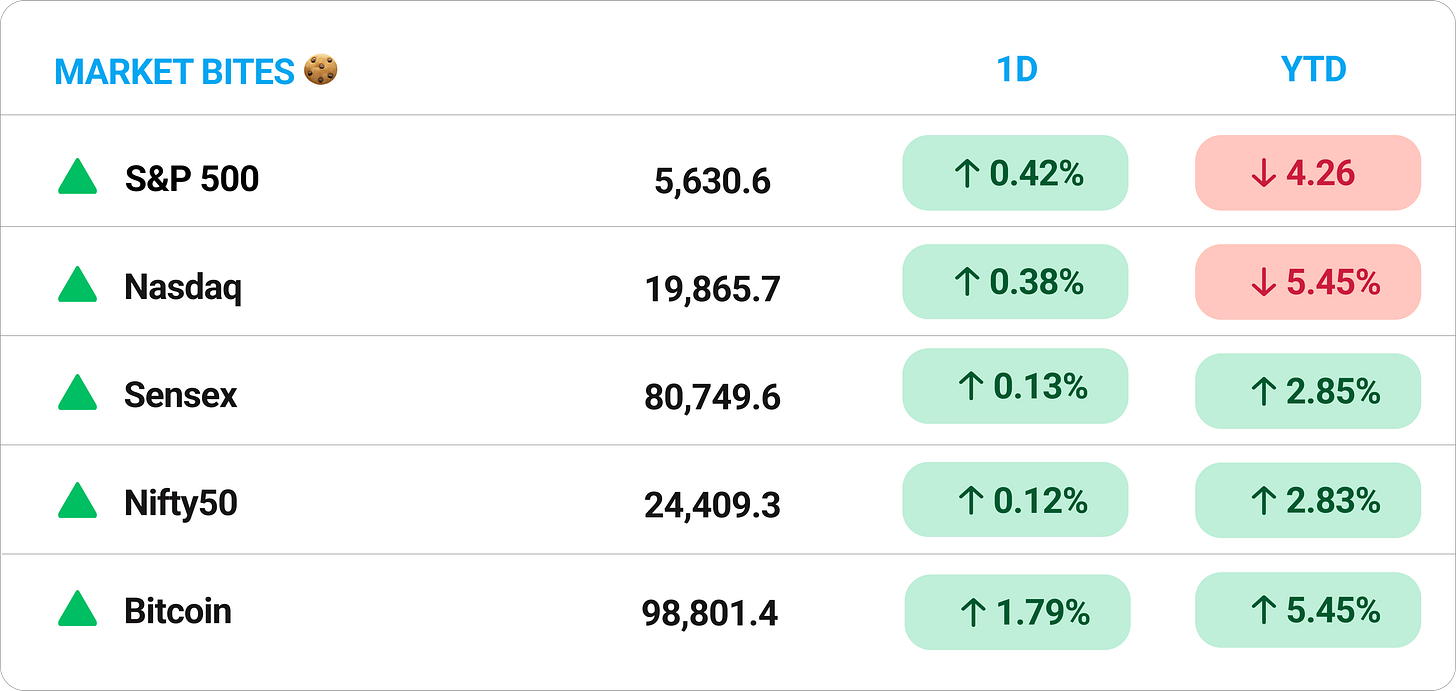

The vibes are tense, but the markets are somehow cool as a cucumber.

Markets ended slightly higher on Wednesday after a volatile session, with support from midcap, banking, and auto stocks. Sensex & Nifty ended flat but in the green.

An upbeat earnings season and fresh optimism around the India-UK Free Trade Agreement kept overall sentiment positive.

💡 Spotlight: the world’s borrowing binge just hit a new high. Global debt ballooned by $7.5 trillion in the first three months of 2025, touching a record $324 trillion, per the Institute of International Finance.

The big push came from China, France, and Germany, while countries like Canada and Turkey actually trimmed their tab. A weaker US dollar also made debt totals look bigger when measured in dollars.

Emerging markets weren’t sitting out either—they added over $3.5 trillion, taking their total debt to a record $106 trillion.

This debt finances everything from buildings to bridges to corporate and consumer assets.

Let’s hit it!

1 Big Thing: MRF rolls out a record dividend 💰🚗

MRF just dropped its Q4 numbers, and while profits rolled in strong, it’s the payout party that’s really making headlines.

The company announced a total dividend of ₹235 per share for FY25, its highest ever, including two interim payouts of ₹3 each and a massive final dividend of ₹229 per share.

By the numbers:

- Net profit rose 33% YoY to ₹492.7 crore in Q4FY25

- Revenue grew 11.4% YoY to ₹7,075 crore

Expenses also climbed 10.3%, mostly in line with rising input and operating costs.

Despite the rising costs, margins held steady, and MRF’s board decided it was time to share the wealth.

Zoom out: MRF is a debt-light, cash-heavy tyre giant with strong pricing power in a still-resilient auto market. The brand also has a remarkable pull across India which makes defending share easy.

And with demand from passenger vehicles and commercial segments holding up, MRF is riding FY25 out with grip and control.

The stock jumped 5% post-earnings as investors cheered the payout news.

While we are on earnings,

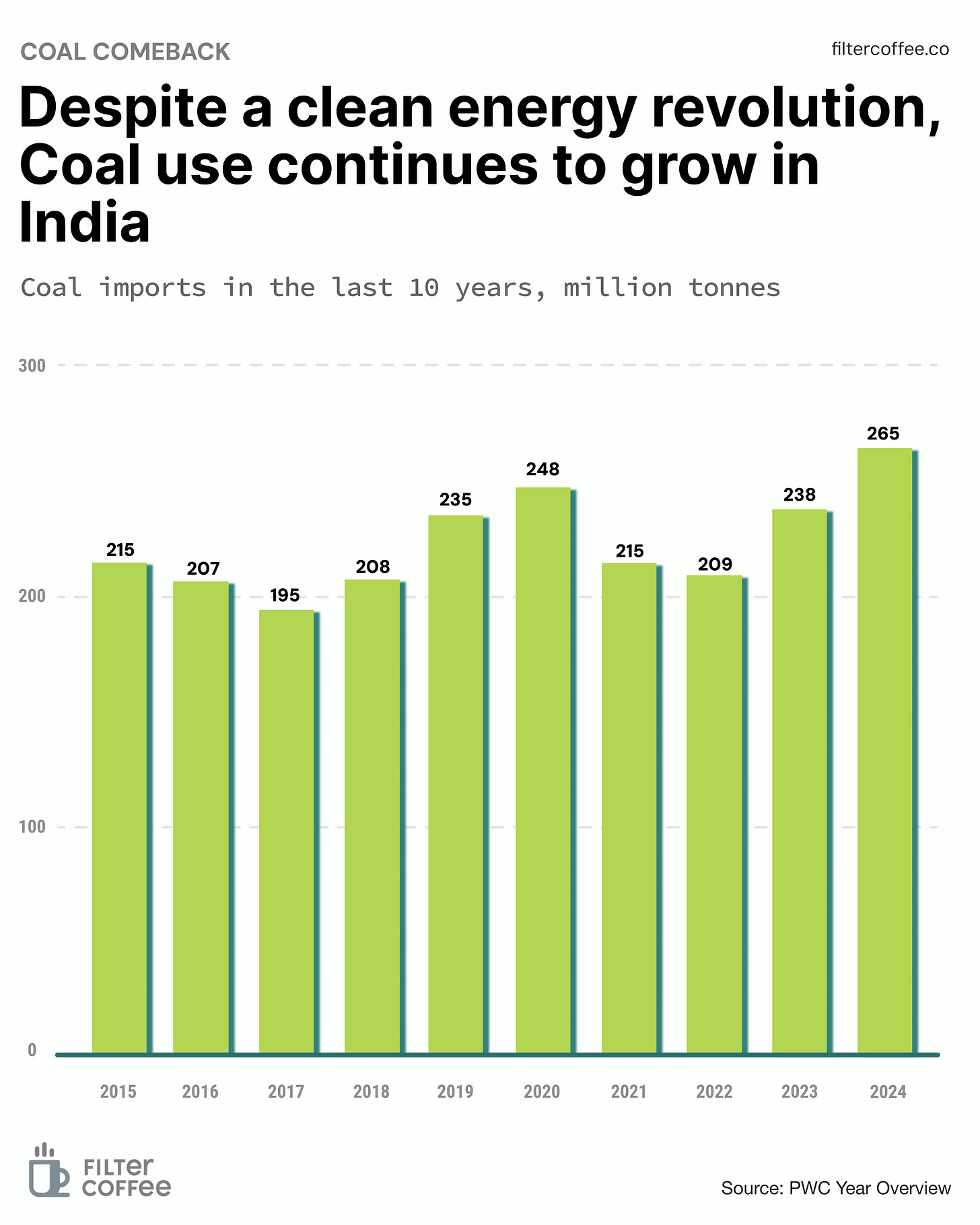

Coal India’s Q4 report is out, and the numbers tell a tale of steady growth on the ground. The real story though is coal production.

By the numbers:

- Profit rose 12% YoY at ₹9,604 crore.

- Revenue from operations was ₹37,824 crore, slightly down 1% YoY,

Coal India produced 241.8 million tonnes (MT) of coal in Q4, up 7.8% from the year-ago period. Coal offtake, or the actual coal delivered to power and industrial users, was 201.6 MT, rising 8% YoY.

Why it matters: Coal India powers over 70% of India’s electricity generation. Higher consumption generally signals healthy economic activity.

2. Mouri Tech is gearing for an IPO 💻

Mouri Tech has refiled its draft papers with SEBI for a ₹1,500 crore IPO.

The deets: Mouri Tech offers “AI-first” IT services helping big businesses go digital, automate workflows, and manage things like cloud infra and smart ERP systems. It operates across four core areas including iERP, enterprise digital transformation, infra services, and project management.

The company plans to raise ₹250 crore by issuing new shares, while promoters and a selling shareholder will offload stock worth ₹1,250 crore.

The why: Mouri will use part of the funds to pay off debt through its U.S. arm (MT USA).

Background: this isn’t the first time Mouri tried to hit the bourses, it filed for an IPO in September 2024, but quietly pulled it in December with no explanation.

3. Novopor is acquiring Pressure Chemical Company

Novopor Advanced Science will acquire Pressure Chemical Company (PCC), a U.S.-based specialist in high-pressure and niche chemistries.

The deets: Novopor is a contract development and manufacturing organisation (CDMO), with Innovation Centres in Hyderabad and manufacturing sites located in Andhra Pradesh and Gujarat. Think of it as the behind-the-scenes expert helping companies develop and scale up high-performance chemicals.

The addition of PCC, which has been doing this since 1964, gives Novopor a stronghold in polymerisation, alkoxylation, and other complex chemistries.

The why: Novopor wants to connect early-stage R&D with full-blown commercial production, and PCC fills that gap neatly. It also helps Novopor expand its U.S. footprint and offer global clients a one-stop shop for fine and specialty chemicals.

Zoom out: the specialty chemicals space is heating up, with pharma, materials, and advanced manufacturing industries all demanding more tailored, high-spec chemical solutions. CDMOs like Novopor are racing to offer end-to-end capabilities and acquisitions like this show they’re playing for the long game.

4. Stocks that kept us interested 🚀

1. NLC India to power up Rajasthan

NLC India just signed a power purchase agreement for an 810 MW solar project with Rajasthan’s state power utility, Rajasthan Rajya Vidyut Utpadan Nigam Limited (RVUNL).

NLC India is a government-owned company known for mining lignite and producing electricity. It was the first government-run company to cross 1 GW in renewable energy capacity.

The deets: the new solar plant, will be set up at the 2000 MW Pugal Solar Park in Bikaner and will generate ~2 billion units (BU) of green electricity annually.

Moreover, it’s expected to cut 1.5 million metric tons of CO2 emissions per year. That’s like pulling 320,000 cars off the road, annually.

2. Tata Motors splits up

Tata Motors stock jumped over 4% after shareholders approved a plan to split the company into two separate businesses.

The Deets: Tata Motors is officially demerging its Passenger Vehicle (PV) and Commercial Vehicle (CV) businesses into two distinct listed companies.

The PV arm includes Jaguar Land Rover and the CV division includes trucks, buses, and heavy movers.

If you own Tata Motors shares, you’ll get one share of the new CV company for every share you currently hold.

The why: these are very different businesses with different rhythms. One caters to luxury and personal mobility, the other runs on logistics and infrastructure.

Separating them allows each to grow with laser focus. which means more clarity, sharper strategy, and potentially, better returns.

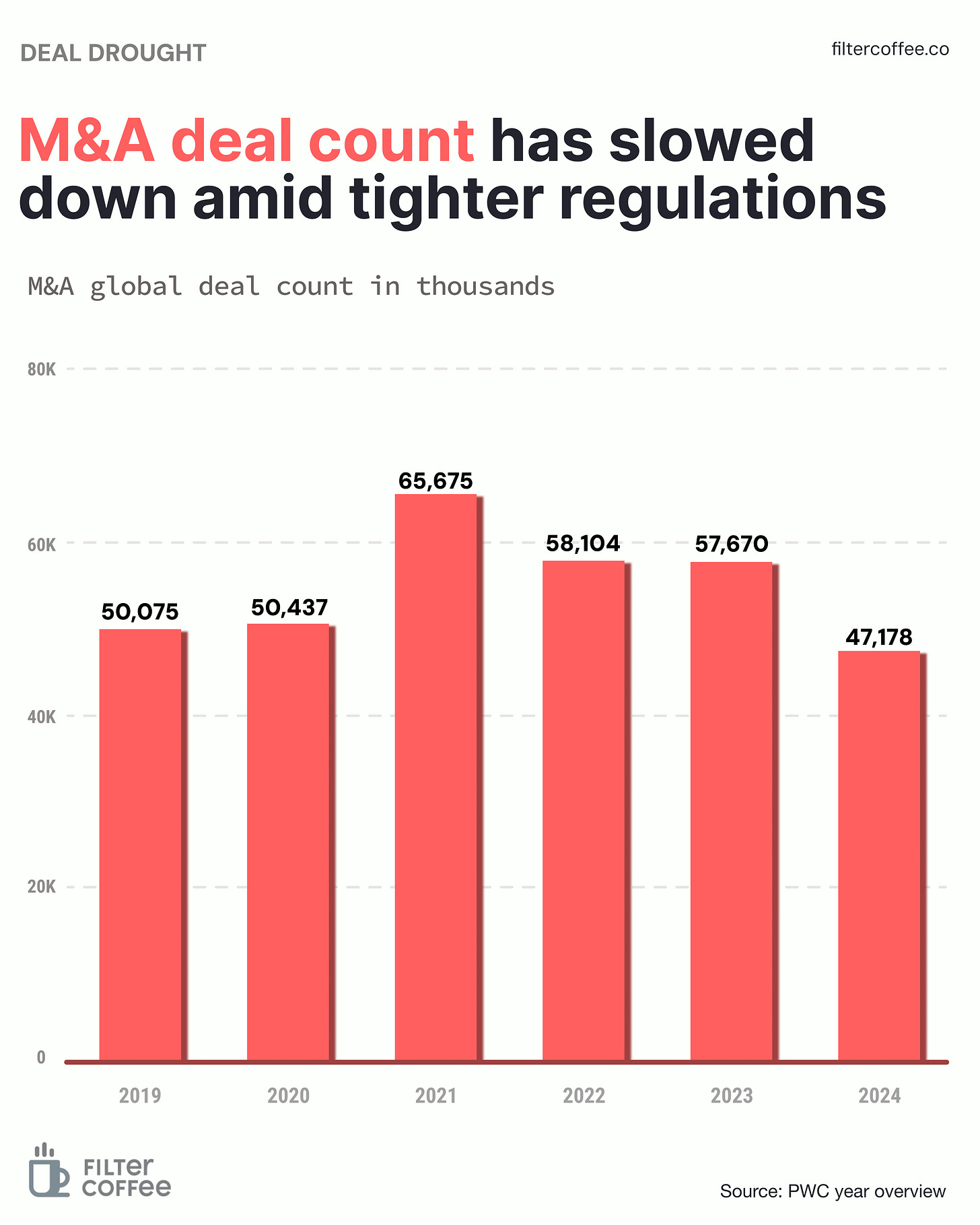

5. Story in data: M&A slowdown 📉

Global M&A deals fell to 47,178 in 2024—the lowest count since 2018.

After a record 2021 boom driven by cheap capital and aggressive expansion, dealmaking has slowed sharply.

Rising interest rates, tighter regulations, and increased antitrust scrutiny have made buyers more cautious.

Big Tech’s appetite has cooled too, thanks to global watchdogs blocking large mergers.

While activity is cooling, analysts say quality deals are still happening—just at a slower, more deliberate pace.

What else are we snackin’ 🍿

🌐 Web block: NSE and BSE have temporarily restricted website access for overseas users after a joint review of potential cyber threats, but foreign investors can still trade as usual.

🤝 Fund fusion: Deutsche Bank’s DWS and Japan’s Nippon Life are in talks to set up an asset management joint venture in India.

📉 Tariff consequences: Chinese goods now make up the smallest share of U.S. imports in over 20 years, thanks to Trump’s tough tariff play.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.